|

|

| |

|

|

| HKECIC Weekly Market News |

| 14 January 2019 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Europe |

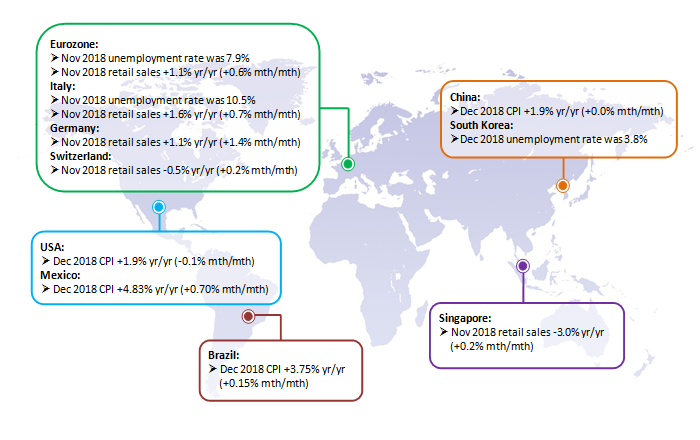

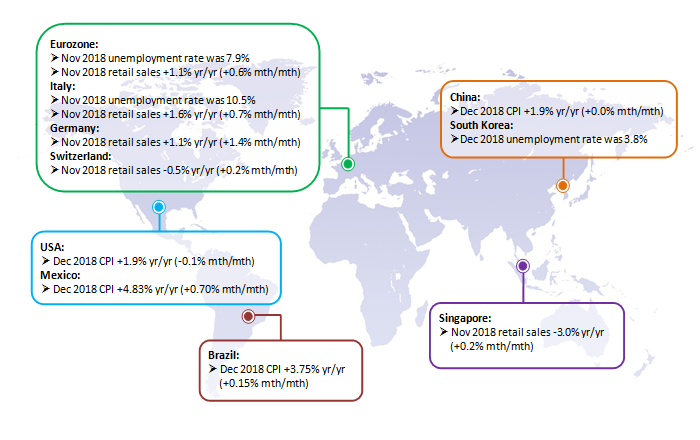

Eurozone: Economic sentiment slips to lowest since January 2017

Data from the European Commission showed that Eurozone’s Economic Sentiment Indicator (ESI) dropped markedly to 107.3 in December 2018 from 109.5 in November 2018, marking the indicators’ 12th consecutive monthly drop and the lowest reading since January 2017. The lower ESI resulted from decreases in four of five sectorial confidence indicators, including industry, consumer (both -2.3), services (-1.4) and construction (-1.0), while confidence in retail trade (+0.5) improved. The ESI weakened in all the five largest Eurozone economies, including Spain (−3.0), France (−2.0), Germany (−1.9), Italy (−1.4) and the Netherlands (−0.3).

Germany: Industrial production dips in November 2018

Germany’s industrial production fell by 1.9% mth/mth in November 2018, deepened from a 0.8% decrease in the preceding month, according to the Federal Statistics Office. This marks the third consecutive month of decline, as output decreased for consumer goods (-4.1%), capital goods (-1.8%) and intermediate goods (-1.0%). Output in the energy (-3.1%) and construction (-1.7%) industry also dropped. The economy ministry attributed the decline to special factors including an unusual high number of long weekend holidays and problems faced by the automotive manufacturers as they adjust to the new emission standards. Nevertheless, Economy Minister Peter Altmaier said the German economy remains strong, noting company order books remain full. |

|

|

| North America |

US: Trade talks with China conclude on positive note

Last week, the US and China officials held vice-ministerial-level meetings in Beijing to discuss over trade and economic issues. The discussions marked the first formal talks since US President Donald Trump and Chinese President Xi Jinping agreed not to impose new tariffs at the G20 summit held in December 2018. The US highlighted China’s pledge to purchase a substantial amount of agricultural, energy, manufactured goods, and other products and services, as well as Trump’s commitment to addressing US persistent trade deficit with China. A statement from China’s Ministry of Commerce said the discussions laid a foundation to resolve concerns held by both sides, and they agreed to maintain close contact. Separately, US Treasury Secretary Steven Mnuchin said that Chinese Vice Premier Liu He will most likely visit Washington in late January for trade talks.

Canada: Central bank cuts growth forecasts amid lower oil price

The Bank of Canada lowered its economic growth forecast for 2019. It now expects growth of 1.7% this year, down 0.4 percentage points from its October’s projection in 2018, reflecting a temporary economic slowdown in Q4 2018 and Q1 2019. The central bank explained the drop in global oil prices has a material impact on the Canada’s outlook, resulting in lower export and national income. Also, household spending will be dampened further by slow growth in oil-producing provinces. Looking ahead, the bank said exports and non-energy investment are projected to grow solidly, supported by foreign demand and the United States-Mexico-Canada Agreement (USMCA), among other things. |

|

|

|

| |

|

|

|

| |

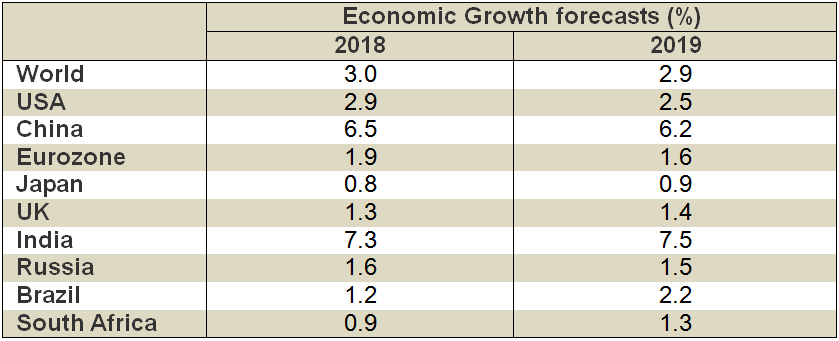

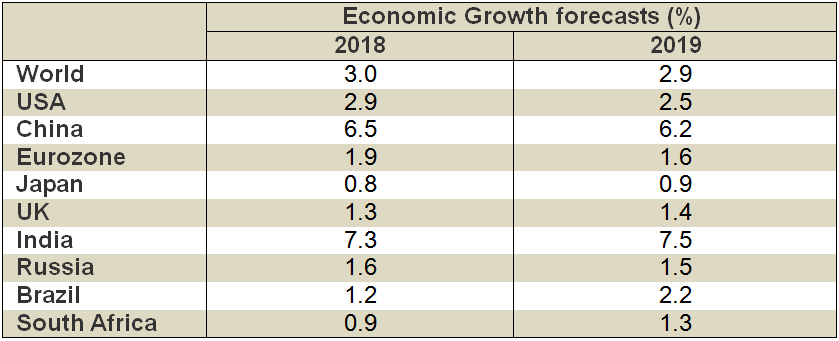

World Bank: Predicts slower global growth in 2019

In its latest Global Economic Prospects, the World Bank forecasts global economic growth to slow to 2.9% in 2019 from a downwardly revised 3% in 2018, citing international trade and manufacturing activity have softened, trade tensions have intensified, and some large emerging markets have experienced substantial financial market pressures. Growth in advanced economies is forecast to slow to 2% in 2019 from 2.2% in 2018, as major central banks continue to withdraw monetary policy accommodation. Besides, against this challenging backdrop, growth in emerging market and developing economies is expected to remain flat at 4.2% in 2019.

|

|

|

|

|

| |

Beauty Brands, a US-based salon and spa retailer, has filed for Chapter 11 bankruptcy protection. The retailer has entered into an asset purchase agreement with Hilco Merchant Resources for a sale of its operating assets. The filing comes just a few weeks after the retailer announced it would be closing 25 stores and cutting down corporate staff. The retailer’s remaining 33 stores would continue operating as it searches for a sale of its operating assets. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2019 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|