|

|

| |

|

|

| HKECIC Weekly Market News |

| 6 May 2019 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Asia and Australasia |

China: Manufacturing PMI remains stable in April

According to the National Bureau of Statistics (NBS), the purchasing managers' index (PMI) for China's manufacturing sector remained stable at 50.1 in April, slightly down from 50.5 in March. A reading above 50 indicates expansion, while a reading below reflects contraction. The reading in April marked the second highest since November 2018. In particular, the sub-indices for production and new orders came in at 52.1 and 51.4 respectively, both showing momentum. NBS senior statistician Zhao Qinghe added that high-tech manufacturing continued to lead the trend and imports and exports showed warming signs. Regarding the trade talks between US and Mainland China, sources reported earlier that China was considering to cancel the planned trip to Washington this week, after US President Donald Trump threatened to increase additional tariffs. Spokesman of China’s Ministry of Foreign Affairs said that the delegation is still preparing to travel to the US for trade talks. Yet, he did not answer a question about the date or whether the group would be led by Vice Premier Liu He.

Hong Kong: Exports down by 1.2% yr/yr in March

The Census and Statistics Department (C&SD) reported that the values of Hong Kong's total exports of goods decreased 1.2% yr/yr in March, after a decrease of 6.9% in February. For the Q1 2019 as a whole, the value of Hong Kong's total exports of goods decreased by 2.4% over the same quarter in 2018. For Q1 2019, decreases were registered to some major destinations, in particular India (-28.4%), Taiwan (-11.3%), the USA (-8.5%), the Mainland China (-6.6%) and Japan (-3.2%). A Government spokesman commented that merchandise exports remained subdued in recent months, as the adverse external environment continued to dampen manufacturing and trading activities in the region. The external trading environment will remain challenging in the near term. The C&SD also announced the Hong Kong’s GDP data for the first quarter of 2019. According to the advance estimates, real GDP increased by 0.5% yr/yr in Q1 2019, compared with an increase of 1.2% in Q4 2018. The moderation in growth was attributable to the slower growth in both domestic demand and external demand. Secretary for Commerce and Economic Development, Edward Yau said the GDP figure suggested that there are still a lot of uncertainties ahead, in particular, depends on whether and how far the US and China would come to an agreement on the trade dispute. |

|

|

| Europe |

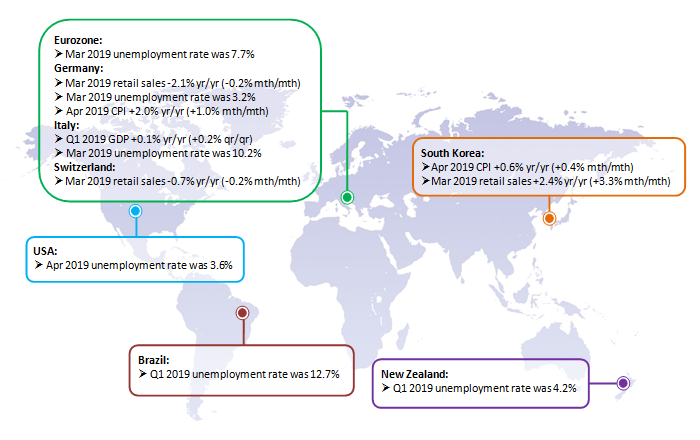

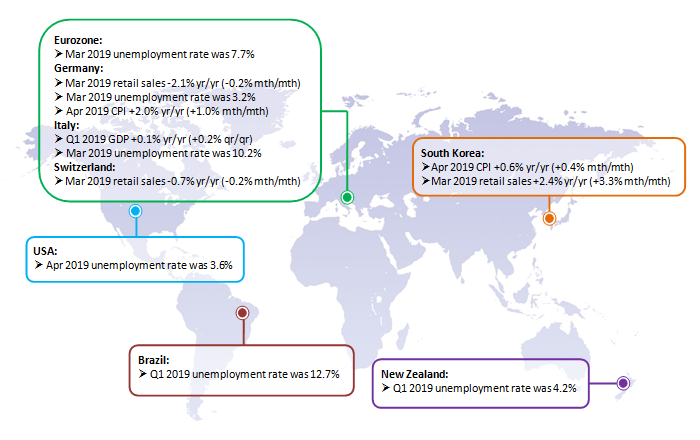

Eurozone: Growth rebounded despite trade war and Brexit

Eurozone’s economy grew 0.4% qtr/qtr in Q1 2019, up from 0.2% in Q4 2018 and 0.1% in Q3 2018, according to the preliminary estimate from Eurostat. The growth rate beat the market expectation of a 0.3% expansion. Remarkably, the Italian economy expanded by 0.2% qtr/qtr, emerging from two consecutive quarters of contraction at the end of last year. Compared with the same quarter last year, the bloc’s economy expanded 1.2% in Q1 2019, the same result as in the previous quarter. Separately, Eurozone’s unemployment rate dropped to 7.7% in March, down from 7.8% in February and marking the lowest rate recorded since September 2008. |

|

|

| North America |

US: Trump threatened to raise tariffs on US$200 billion of Chinese goods on Friday

US President Donald Trump wrote on Twitter that he would raise additional tariffs on US$200 billion of Chinese goods from 10% to 25% on Friday (10 May 2019), and that US$325 billion of additional Chinese goods that have not been taxed would be subject to additional tariffs of 25% shortly. Trump said the trade deal with China continues, but too slowly, as China attempts to renegotiate it. Separately, the Federal Open Market Committee (FOMC) kept the target range for the benchmark federal funds rate unchanged at 2.25%-2.5% last week. FOMC statement indicates that labor market remained strong and that economic activity rose at a solid rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Federal Reserve Chairman Jay Powell said the policy stance was appropriate and he sees no immediate need to move interest rates either higher or lower, with the central bank still watching intently for a rebound in persistently sluggish inflation. Core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure, was flat in March and up 1.6% yr/yr and remained below the central bank’s 2% target. |

|

|

|

| |

|

| |

|

|

| |

Pier 1 Imports Inc. (NYSE:PIR), a US-based retailer of decorative accessories, furniture, candles, housewares, gifts, and seasonal products, reported its fiscal 2019 results ended 2 March 2019. The company reported net sales of US$1.6 billion, a decrease of 13.7% from last year. Net loss for fiscal 2019 totaled US$198.8 million, compared to net income of US$11.6 million for fiscal 2018. On 24 April, S&P lowered the issuer credit rating on Pier 1 to 'CCC-' from 'CCC+'. The rating outlook is negative. The downgrade reflected S&P's view that the potential for a bankruptcy filing or debt restructuring is continuing to increase, given S&P's expectation for continued net losses over the coming year. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2019 Hong Kong Export Credit Insurance Corporation |

|

|

|