|

|

| |

|

|

| HKECIC Weekly Market News |

| 10 June 2019 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Asia and Australasia |

Australia: Central bank cuts interest rates for first time in 3 years

The Reserve Bank of Australia (RBA) has cut its benchmark interest rate by 25 basis points to a record low of 1.25%. It marks the first change to the rate since August 2016 in a bid to stimulate a slowing economy. The central bank said in a media release that it took this decision to support employment growth and provide greater confidence that inflation will be consistent with the medium-term target. The RBA governor Philip Lowe remained optimistic about the Australian economy, seeing 2.75% growth in 2019 and 2020. Separately, data from the Australian Bureau of Statistics showed that the economy grew 1.8% yr/yr in Q1 2019, fell far short of the long-term average of 3.5% and was the weakest since the global financial crisis.

South Korea: Economy shrinks more than expected in first quarter

The Bank of Korea’s revised data showed that South Korea’s real GDP decreased by 0.4% qtr/qtr in Q1 2019, down from the advanced estimate of a 0.3% fall. The revised official figure was the deepest drop since 2008, dragged down by slowing global demand for electronics. Exports contracted by 3.2%, led by decreases in electrical and electronic equipment such as LCDs and semiconductors. Imports also decreased by 3.4%, owing to contraction in imports of machinery & equipment along with those of coal and petroleum products. A separate report from Statistics Korea showed that the core inflation slowed to a near 20-year low of 0.6% yr/yr in May, raising the likelihood the central bank will cut the interest rates in the near term. |

|

|

| North America |

US: Fed says businesses are worried about trade war

The US Federal Reserve’s “Beige Book” report, a compendium of anecdotes on the state of the economy, pointed to numerous cases of businesses citing concern over the Trump administration’s trade war with China. From April through mid-May, US economic activity expanded at a modest pace, a slight improvement over the previous period. Manufacturing reports were generally positive, but some districts noted signs of slowing activity and a more uncertain outlook among contacts. Reports on consumer spending were generally positive but tempered. The Beige Book also pointed to cases in several districts in which businesses expressing concerns over the current trade dispute with China. Last weekend, US Treasury Secretary Steven Mnuchin met with People's Bank of China Governor Yi Gang at the G20 finance leaders meeting in Japan, marking the first face-to-face discussion between senior US and Chinese officials in nearly a month. |

|

|

| Africa |

South Africa: Economy contracts in Q1

South Africa’s real GDP declined by 3.2% qtr/qtr in Q1 2019, following an increase of 1.4% in Q4 2018 and marks the largest quarterly drop in 10 years, data from Statistics South Africa showed. Seven of the ten industries took a knock, with manufacturing, mining and trade the biggest contributors to the fall. In particular, weaker wholesale, retail and motor sales dragged the trade industry down by 3.6%. An International Monetary Fund (IMF) mission, visited South Africa during 27 May - 3 June 2019 to discuss recent economic developments and outlook in the context of its regular surveillance activities. After the visit, IMF has urged South Africa to speed up structural reforms to boost economic growth. |

|

|

|

| |

|

|

|

| |

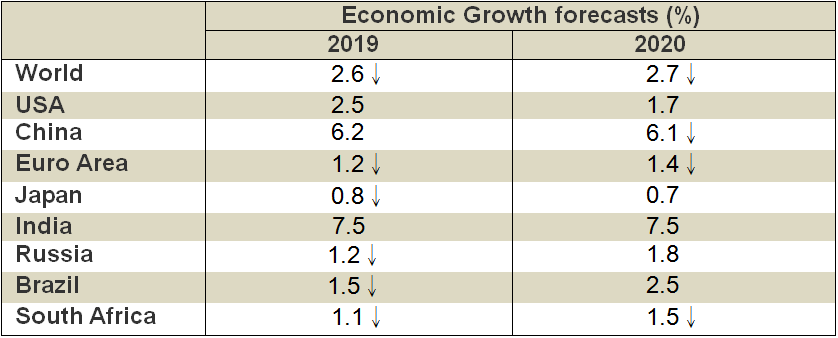

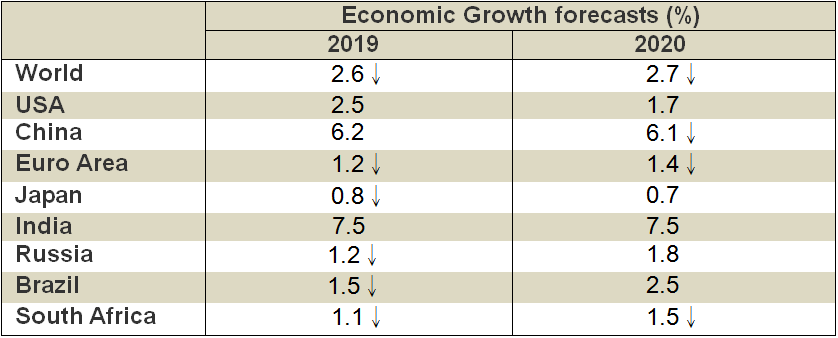

World Bank: Global growth downgraded to 2.6% in 2019

In its latest Global Economic Prospects, the World Bank forecasts the global economy will grow 2.6% in 2019 (down 0.3 percentage point from its forecast in January). The downgrade reflects the board-based weakness observed during the first half of the year, including a further deceleration in investment amid rising trade tensions. In particular, global trade growth in 2019 is revised down to 2.6% (down 1.0 percentage point from its forecast in January). Besides, the World Bank sees global growth to gradually rise to 2.7% in 2020 and 2.8% in 2021, predicated on continued benign global financing conditions, as well as a modest recovery in emerging market and developing economies (EMDEs) previously affected by financial market pressure.

*Arrows indicate the direction of revisions since January 2019 |

|

|

| |

|

|

| |

FTD Cos. Inc. (NASDAQ:FTD), a US-based flower-delivery business, has filed for Chapter 11 bankruptcy protection, planning to put its businesses up for sale to pay off an overload of debt it took on to buy former rival ProFlowers in 2014. The company had approximately 872 workers in North America at the time of bankruptcy filing. The company said it will continue to support its network for florists as it carries out business as normal. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2019 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|