|

|

| |

|

|

| HKECIC Weekly Market News |

| 11 November 2019 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

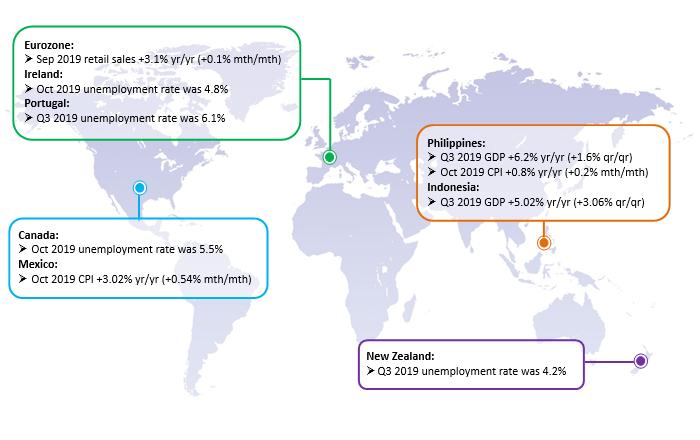

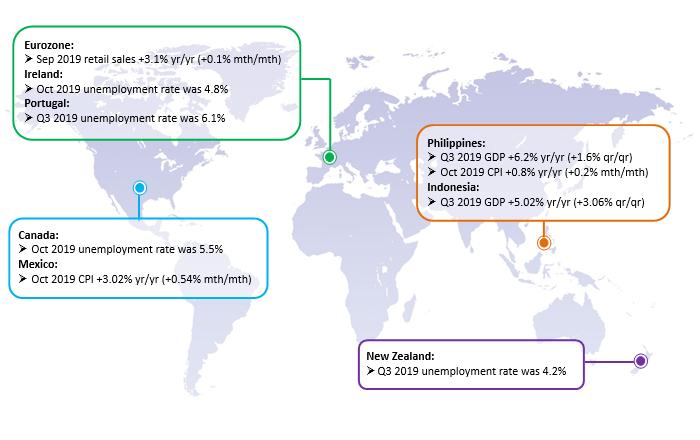

| Asia and Australasia |

Indonesia: Economic growth slows in Q3

According to Indonesia’s National Bureau of Statistics, the Indonesia economy grew by 5.02% yr/yr in Q3, the slowest growth since Q2 2017 and moderated from 5.05% in Q2. Household consumption, which accounted for over half of the economic growth, rose at 5.01% compared to 5.17% in Q2. Meanwhile, fixed investment and government spending rose at a slower rate. In a bid to prop up the local economy against a backdrop of worsening global economic moderation, the central bank of Indonesia has cut its benchmark interest rate four times by a total of 100 basis points since July to the present level of 5%. A slowdown in economic growth raises the likelihood that the central bank will further lower the interest rate at the November meeting.

Australia: Central bank keeps interest rate at record low of 0.75%

The Reserve Bank of Australia (RBA), at its November meeting, decided to hold the benchmark interest rate at its record low of 0.75% after three consecutive rate cuts from 1.5% since June. The RBA Governor Philip Lowe said the upswing in housing values showed a strengthening economy, while the sustained period of modest increases in household disposable income continuing to weigh on consumer spending. The Bank now sees the Australian economy to grow by around 2.25% this year and gradually to pick up to around 3% in 2021. |

|

|

| Europe |

Europe: IMF forecasts European economy to grow at its lowest rate since 2013

In its latest Regional Economic Outlook report, the International Monetary Fund (IMF) projected that the economic growth across the continent will moderate to 1.4% in 2019 from 2.3% in 2018, the slowest pace of growth since 2013, before recovering to 1.8% in 2020, citing weakness in trade and manufacturing. Amid high uncertainty, risks remain to the downside, with a no-deal Brexit the key risk in the near term, which could have a sizeable negative impact on the economies in the region. In particular, vehicle production has slowed in the region, partly due to tighter emission standards, a shift in preference toward alternative fuel vehicles and weakening demand from China. The IMF warned that this would have a negative impact to Germany as well as Central and Eastern Europe. |

|

|

| North America |

US: Trade deficit narrows in September

The US Department of Commerce reported that US’s goods and services deficit narrowed to US$52.5 billion in September from US$55.0 billion in August. The trade deficit has shrunk to the lowest level in five months, as exports dropped 0.9% mth/mth to US$206.0 billion, while imports went down at a deeper pace of 1.7% mth/mth to US$258.4 billion. By commodity group, exports of soybeans, automotive vehicles, parts, and engines decreased, while imports of cell phones, household goods, toys, games and sporting goods as well as semiconductors decreased. Meanwhile, goods trade deficit with China narrowed US$0.9 billion to US$28.0 billion in September. |

|

|

|

| |

|

| |

|

|

| |

Mothercare Plc (LON: MTC), a UK-based maternity retailer, has gone into administration and puts 2,800 jobs at risk. It became the latest brick-and-mortar retailer to fall victim to the rise of e-commerce and increased costs, particularly on high rents. The company plans to close all of its 79 UK stores and its online business after calling in administrators from PwC. The administration will not include the group’s overseas operations. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2019 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|