|

|

| |

|

|

| HKECIC Weekly Market News |

| 6 April 2020 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Asia and Australasia |

China: Manufacturing PMI rebounds in March

According to the National Bureau of Statistics (NBS), China’s manufacturing Purchasing Managers' Index (PMI) came in at 52.0 in March, recovering from a record low of 35.7 in February when the country was effectively shut down due to COVID-19. A reading above 50 reflects expansion, while a reading below indicates contraction. NBS senior statistician Zhao Qinghe attributed the rebound to the country’s successful efforts in coordinating epidemic control as well as economic and social development. However, the single-month rise does not necessarily mean the production has fully returned to pre-outbreak levels. He added that the upturn of economy only comes when the PMI moves up for at least three consecutive months. A separate survey conducted by the NBS showed that as of 25 March, 96.6% of China's large and medium-sized enterprises have resumed production, up 17.7 percentage points from the result one month ago.

South Korea: Exports fall 0.2% in March

South Korea’s exports decreased 0.2% yr/yr to US$46.9 billion in March, according to the Ministry of Trade, Industry and Energy. Imports slipped 0.3% to US$41.9 billion, sending the trade surplus to US$ 5.0 billion. Despite pessimistic expectations of a sharp contraction following the spread of the COVID19, the Ministry said that exports in March remained close to those of the previous year. Remarkably, exports of computers soared 82.3%, as more people are working from home and there is an increased demand in global data centers and servers. By contrast, exports of semiconductors (-2.7%), petrochemicals (-9.0%) and petroleum products (-5.9%) showed reduction amid weakened global demand and fall in oil prices. The Ministry predicted that, as the novel coronavirus crisis escalated in the US and the European Union, the impacts on the economy could be more apparent after April. |

|

|

| Europe |

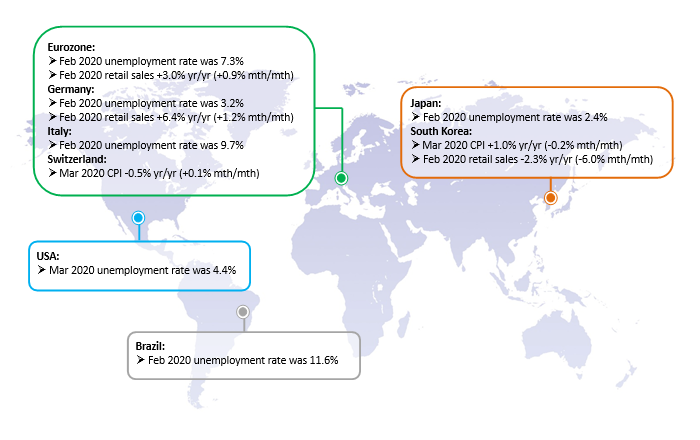

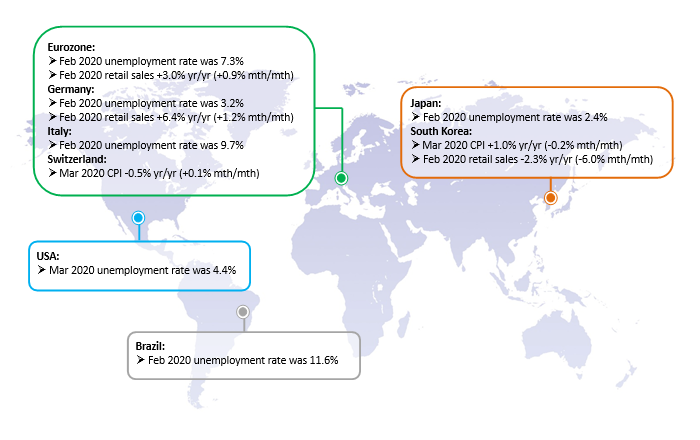

Eurozone: Economic sentiment suffers worst monthly slump

Data from the European Commission showed that Eurozone’s Economic Sentiment Indicator (ESI) fell dramatically to 94.5 points in March from 103.4 in February. This posts the strongest monthly decline in the ESI on record, with optimism surrounding consumers and all business sectors deteriorated amid the COVID19 outbreak. Amongst the largest Eurozone’s economies, the fall was led by Italy (-17.6), where strict lockdown was first imposed, followed by Germany (-9.8) and France (-4.9). On a separate note, the German’s panel of economic advisers warned that a recession in Europe's powerhouse is inevitable. In its worst-case scenario, the advisers said the German economy could contract by up to 5.4% in 2020. |

|

|

| North America |

US: Initial jobless claims soared to 6.6 million

The US Department of Labor announced that US unemployment rate rose to 4.4% in March from 3.5% in February. This marks the highest unemployment level since August 2017. Initial jobless claims, a gauge of the US labor market trends, doubled to a record high of more than 6.6 million in the week ended 28 March 2020 from the preceding week, as layoffs emerging from the COVID-19 outbreak spread rapidly. Unemployment claims at this level points to a severe job market decline that would likely push the employment rate even higher in April. Regarding the COVID-19 epidemic, US has more than 336,000 infections, the highest number in the world, with death toll surpassing 9,000. Last week, US President Donald Trump said the death toll could reach up to 240,000, and the Americans will go through a very tough two weeks. |

|

|

|

| |

|

| |

|

|

| |

Taiwan-based electronics contract manufacturers Hon Hai Precision Industry Co., Ltd. (“Foxconn”) (TWSE: 2317) has announced its financial results for the year ended 31 December 2019. For the year under review, group revenue edged up 1% to NT$ 5,343 billion in 2019, while net income fell 11% to NT$ 115 billion. Foxconn warned last month that revenue would fall more than 15% in businesses including consumer electronics in the first quarter. But it said revenue would recover thereafter as production returns to normal in virus-hit China.

Xiaomi Corporation (HKSE: 1810), one of the world's leading smartphone makers, has announced its financial results for the year ended 31 December 2019. In 2019, group revenue increased 17.7% to RMB 205.8 billion, while net income fell 25.0% to RMB 10.1 billion. On impact of the COVID-19 outbreak in the China market, Xiaomi said that it was comparatively less impacted due to its strength in online channels, while overseas market will likely to be negatively affected, particularly in the second quarter of 2020. Meanwhile, Xiaomi will continue to focus on 5G smartphones development and strengthen its presence in the premium smartphones segment.

Hong Kong-based fashion retailer Esprit Holdings Limited (HKSE: 330) has placed six German subsidiaries in self-administration to give them protection during the COVID-19 crisis. Esprit said in a statement that all its European stores have been closed due to public health measures to slow the spread of COVID-19. Esprit describes the protective self-administration as a proactive and forward-looking measure to protect the solvency and liquidity of the group.

UK-based hire-purchase retailer of household goods Caversham Finance Limited, trading as BrightHouse, has filed for administration. It becomes the latest retail casualty amid the spread of COVID19, placing up to 2,400 jobs across 240 stores at risk. Joint Administrators Grant Thornton UK LLP said they are now in full control of the retailer’s business operations and will continue to trade the businesses in line with the government guidance as to remote working. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2020 Hong Kong Export Credit Insurance Corporation |

|

|

|