|

|

| |

|

|

| HKECIC Weekly Market News |

| 12 April 2021 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Asia and Australasia |

Hong Kong: PMI improves in March

The IHS Markit Hong Kong Purchasing Manager’s Index (PMI) rose to 50.5 in March from 50.2 in February. This suggested that private sector continued to expand marginally in March. Latest data pointed to a further modest reduction in new orders amid the ongoing impact of the COVID-19 pandemic. Meanwhile, some firms indicated that a slight easing of pandemic restrictions had provided signs of improving demand. Both new business from Mainland China and overall new export orders decreased at reduced rates in March. Economics Director at IHS Markit, Andrew Harker, said in a statement that March’s reading provided cautious optimism that the private sector would soon be able to break the cycle of downturns that has afflicted companies over the past three years.

Australia: RBA signals no rate rise until at least 2024

The Reserve Bank of Australia (RBA) has left its benchmark interest rate unchanged at the historic low of 0.1%. The central bank said in a media release that economic recovery in Australia is well under way and is stronger than had been expected, with employment returning to the pre-pandemic level. However, wage and price pressures are subdued and are expected to remain so for some years. Underlying inflation is expected to remain below 2% over the next few years. The bank now sees the highly supportive monetary conditions will be in force until at least 2024 when actual inflation is sustainably within the 2% to 3% target range. |

|

|

| Europe |

Turkey: Inflation rises for sixth month in a row

Data from the Turkish Statistical Institute showed that Turkey’s consumer price index (CPI) increased by 16.19% yr/yr in March, up from 15.61% in February. The inflation rate accelerated for the sixth consecutive month, as prices rose faster for all main expenditure groups, including transportation (+24.85%), furnishing and household equipment (+23.64%), as well as miscellaneous goods and services (+21.49%). Last month, Turkey’s President Recep Tayyip Erdogan sacked central bank’s governor Naci Agbal after the bank hiked its benchmark interest rate to 19% in an attempt to contain the elevating inflation. The Turkish lira has once declined by about 15% against the US dollar since the sacking. The bank’s next rate decision meeting is on 15 April. |

|

|

| North America |

US: Yellen pushes for global minimum corporate tax rate

Last week, US Treasury Secretary Janet Yellen urged the G20 countries to agree a global minimum corporate tax rate to help stem the erosion of government revenues. Yellen stressed that it is important for governments to have stable tax systems that raise sufficient revenues in essential public goods and respond to crises, and that all citizens fairly share the burden of financing government. The US government has announced a US$2 trillion infrastructure plan, which was expected to be paid by a higher corporate tax rate, an increase in its global minimum tax rate, among other measures. Italy’s (rotating presidency of the G20) Finance Minister Daniele Franco said the G20 hope to reach an agreement on international corporate taxation by a ministerial meeting in July. |

|

|

|

| |

|

|

|

| |

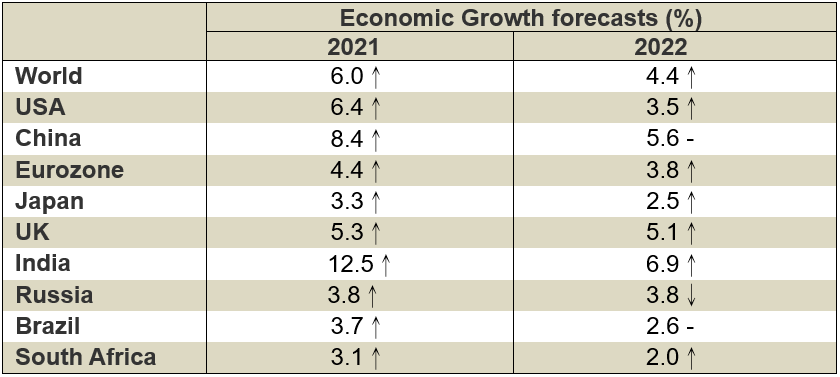

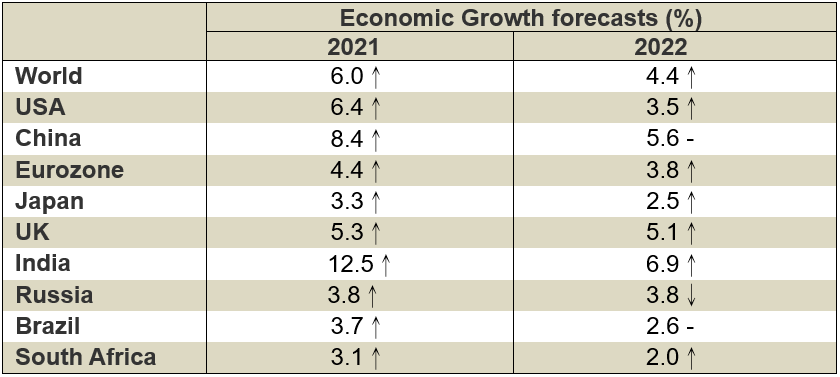

IMF raises global growth forecast for 2021 and 2022

In its latest World Economic Outlook, the International Monetary Fund (IMF) projects global economy to grow by 6.0% in 2021 and 4.4% in 2022, up from its January estimates of 5.5% and 4.2% respectively. The IMF explained that the upward revision reflected additional fiscal support in a few large economies, the anticipated vaccine-powered recovery in the second half of 2021, and continued adaptation of economic activity to subdued mobility. Nonetheless, the outlook presents daunting challenges related to divergences in the speed of recovery both across and within countries and the potential for persistent economic damage from the crisis.

Remark: Arrows indicate the direction of revisions since January 2021. An “-” indicates no change from the January estimate. |

|

|

| |

|

|

| |

US-based fashion company The Collected Group, LLC has filed for Chapter 11 bankruptcy protection amid the COVID-19 pandemic with a plan to reduce its debt. Chief Restructuring Officer Evan Hengel said the company's operations were upended by the pandemic, with retail revenue falling by 85% and wholesale revenue falling by 70% in 2020. The struggling company is now looking to fully wind down its physical locations and to focus on e-commerce and wholesale channels. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Sas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2021 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|