| [ 繁 | 简 | ENG ] |

|

|

|

|

| Issue 507 | 3 May 2022 |

|

Industry News |

Global smartphone shipments down 11% in Q1

Statistics report from Canalys showed that worldwide smartphone shipments fell 11% yr/yr amid unfavorable economic conditions and sluggish seasonal demand in the first quarter of 2022. Samsung led the market with a 24% share, up from 19% in Q4 2021 as the vendor revamped its 2022 portfolio. Apple came second, with a solid Q1 thanks to growing demand for its iPhone 13 series. Xiaomi stayed in third place due to the stellar performance of its Redmi Note series. OPPO (including OnePlus) and vivo completed the top five with 10% and 8% shares. |

|

|

|

|

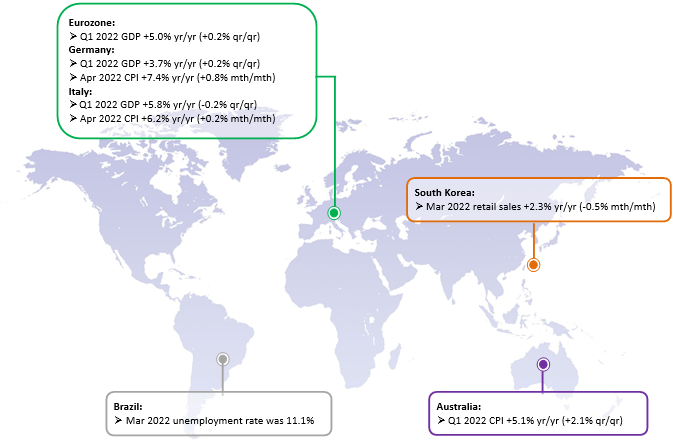

| Asia and Australasia |

Hong Kong: Exports down 8.9% yr/yr in March

The Census and Statistics Department reported that the value of Hong Kong's total exports of goods decreased by 8.9% yr/yr in March, easing from a rise of 0.9% in February. Exports to the Mainland fell 12.8% and those to the US posted decelerated growth of 7%. For the first quarter of 2022 as a whole, the value of total exports of goods increased by 3.4% over the same period in 2021. A Government spokesman said global inflation and monetary policy tightening of major central banks, as well as heightened geopolitical tensions would continue to weigh on the global economic outlook, posing challenges to Hong Kong's export performance. Nonetheless, the stabilised local epidemic of late should be conducive to the gradual alleviation of cross-boundary transportation disruptions.

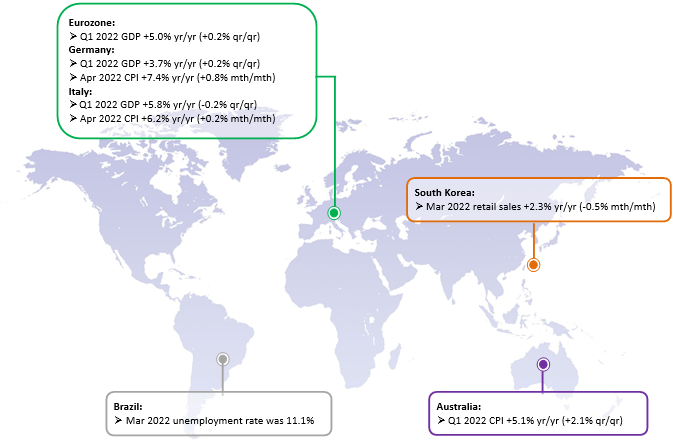

South Korea: Economic growth slows in Q1

South Korea’s real GDP increased by 0.7% qtr/qtr in Q1, down from 1.2% in Q4 2021, according to an advance estimate from the Bank of Korea. Private consumption, which generates nearly half of the country’s GDP, fell by 0.5%, as expenditures on semi-durable goods and services decreased. Investment decreased 1.8% as expenditures on construction and facilities both fell, 2.4% and 4.0% respectively. Domestic demand was dragged by COVID-19 restrictions, high inflation, and uncertainty over the Russia-Ukraine war. Exports increased by 4.1% as exports of goods such as semiconductors and coal & petroleum products expanded. Imports were up by 0.7% due to imports of crude oil. Hwang Sang-pil, a director at the Bank of Korea, said that the growth in Q1 was largely contributed by net exports. However, the prolonged Ukraine crisis and China's slowdown were negative factors for exports. Some analysts expected the consumption in Q2 would improve considerably given the country’s social distancing rules were lifted in April.

Sri Lanka: World Bank to provide bailout funds

According to the media division of the Sri Lanka government, World Bank had agreed to provide Sri Lanka with US$600 million to help the country address the economic crisis. Meanwhile, Sri Lanka was still in talks with International Monetary Fund (IMF) for a bailout package of around US$3-4 billion. Before securing IMF’s assistance, the Sri Lankan government had to draw up a plan, outlining the country’s roadmap toward economic stability. Earlier this month, Sri Lanka missed interest payments on its US$1.25 billion international sovereign bonds maturing in 2023 and 2028. Global rating agency Standard and Poor’s lowered Sri Lanka‘s sovereign credit rating to “SD” (selective default) from “CC” as a result. |

|

| Europe |

UK: Consumer confidence plunges in April

A survey measuring the degree of optimism that UK consumers have regarding their economy indicated their sentiment worsened significantly. The GfK Consumer Confidence Index fell from -31 in the preceding month to -38 points in April, the lowest level since the 2008 global financial crisis. All measures had declined this month. Consumers felt their personal financial situation and the general economic situation for the year ahead got worse amid the soaring prices. GfK’s Client Strategy Director commented that with rising interest rates, surging prices, decelerating economic growth and declining incomes, consumers would be extremely cautious about any spending. Income squeeze was hitting consumer morale. |

|

| North America |

US: Economic activity contracts in Q1

According to an advance estimate released by the Department of Commerce, US GDP decreased at an annualized rate of 1.4% in Q1 2022, switching from a growth of 6.9% in the preceding quarter. This marked the first negative reading since the COVID-19 outbreak in 2020. Personal consumption expenditures, which accounts for about two-thirds of the total GDP, grew 2.7% in Q1, extending a 2.5% growth in Q4 2021. Private domestic investment modestly expanded by 2.3%. Meanwhile, exports were down 5.9% and imports were up 17.7%, causing a drag of 3.2 percentage points on headline GDP. The White House commented that despite facing challenges of COVID-19, the Russia-Ukraine war, and global inflation, the economy remained resilient with consumer spending and investment increasing at strong rates. |

|

| |

|

Webinar

Topic :《Seize export opportunities through risk management under global inflation》

Date : 12 May 2022 (Thu)

Time : 4:00 p.m. - 5:00 p.m. |

|

|

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong

Phone:2732 9988 Website:www.hkecic.com E-mail:info@hkecic.com |

Follow Us: |

|

|

|

Please do not reply to this email. If you would like to continue to receive these communications from us, you do not need to take any action.

However, if you no longer wish to receive email messages from HKECIC, please click “unsubscribe”

Copyright © 2022 Hong Kong Export Credit Insurance Corporation |

|