|

|

| |

|

|

| HKECIC Weekly Market News |

| 3 July 2018 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Asia and Australasia |

Hong Kong: Exports up 15.9% yr/yr in May

The Census and Statistics Department reported that the values of Hong Kong's total exports of goods increased by 15.9% yr/yr in May, after an increase of 8.1% in April. For the first five months of 2018 as a whole, the value of Hong Kong's total exports of goods rose by 10.7% over the same period in 2017. The increases were registered to most major destinations, in particular Singapore (+16.9%), the Mainland China (+14.0%), Germany (+12.8%), Taiwan (+12.2%), US (+9.4%) and Thailand (+7.1%). A Government spokesman commented that the current momentum of the global economy should remain supportive to Hong Kong's exports in the near term. Yet, external uncertainties have increased markedly as a result of the escalation of trade conflicts between the US and the Mainland China. |

|

|

| Europe |

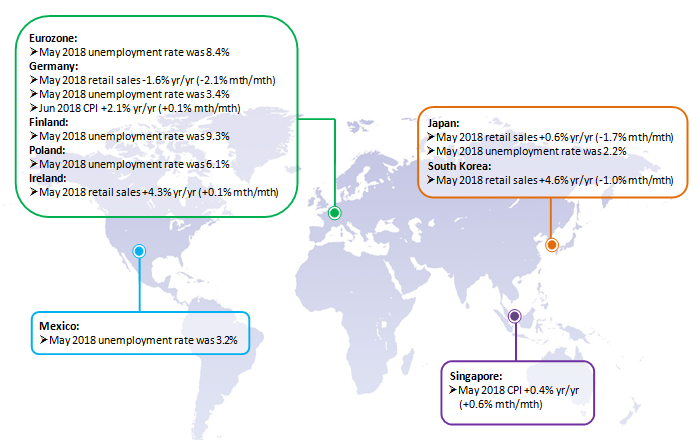

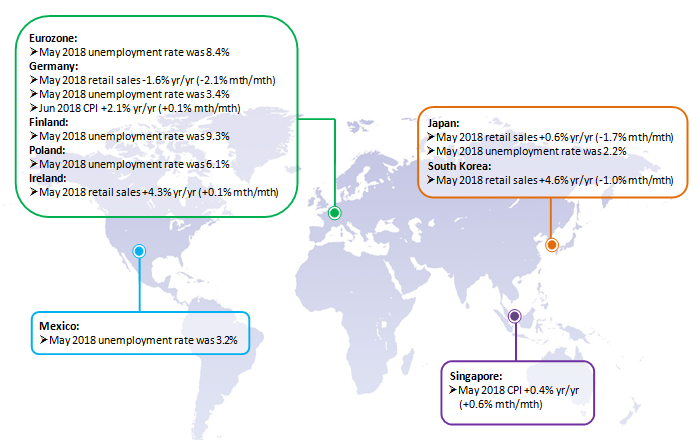

Eurozone: Economic sentiment broadly stable in June

Eurozone’s Economic Sentiment Indicator (ESI) remained virtually unchanged for the third consecutive month in June, registering a marginal decrease of 0.2 points to 112.3, according to data from the European Commission. Broadly unchanged sentiment resulted from decreases in two of five sectoral confidence indicators, including construction (-1.5) and consumer (-0.7) while industry and services remained unchanged (+0.0) and retail trade (+0.1) increased. Amongst the largest eurozone economies, the ESI rose noticeably in Italy (+1.2) and France (+1.0), while it decreased in the Netherlands (−1.8) and Germany (-0.8). |

|

|

| North America |

US: To rely on updated law to curb foreign investment

The Trump administration has decided to rely on existing law, being updated by Congress, rather than executive actions to restrict foreign acquisitions of sensitive American technology and intellectual property. US President Trump said in a statement that the Foreign Investment Risk Review Modernization Act (FIRRMA) will provide additional tools to combat the predatory investment practices that threaten US critical technology leadership, national security and future economic prosperity. Upon enactment of FIRRMA legislation, the US would implement it promptly and enforce it rigorously, with a view toward addressing the concerns regarding state-directed investment in critical technologies identified in the Section 301 investigation. Furthermore, the US government blocked China Mobile from offering services to the US telecommunications market because of its government-owned background posed national security risks. Separately, Standard & Poor’s affirmed the country’s AA+ long-term sovereign credit rating with stable outlook. The rating was supported by the resilience and diversity of the US economy, extensive monetary policy flexibility while constrained by its high general government debt, rising deficits, relatively short-term-oriented policymaking and uncertainty about policy formulation. |

|

|

| Latin America |

Mexico: Trade deficit widened in May

Mexico recorded a trade deficit of US$1.59 billion in May, compared with US$1.20 billion a year ago, according to the National Statistics Institute. Imports grew11.5% yr/yr to a historic high of US$40.76 billion in May, driven by higher oil prices. Exports grew at a softer 10.9% yr/yr to US$39.18 billion. Exports of steel products rose nearly 40% from a year earlier. May was the last month before the US began applying tariffs on steel and aluminum imports from Mexico, Canada and the European Union. Separately, the Mexico’s presidential election was held on 1 July 2018. Preliminary results showed that left-wing candidate Andrés Manuel López Obrador secured a win for the six-year presidency. Incumbent president Enrique Peña Nieto is not eligible for a second term according to Mexico's constitution. |

|

|

|

| |

|

| |

|

|

| |

The Factory Shop Limited, a UK-based discount retailer, has launched a company voluntary arrangement (CVA) proposal and is proposing to close 32 of its 224 stores. The chain said that it was hit by a challenging retail environment and business specific issues.

J Mendel Inc., a US-based fashion house, has filed for Chapter 11 bankruptcy protection to restructure its debt. According to court filing, the company listed assets in the range of US$1 million to US$10 million and liabilities in the range of US$10 million to US$50 million. |

|

|

| |

| |

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2018 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|