| [ 繁 | 简 | ENG ] |

|

|

|

|

| Issue 481 | 18 Oct 2021 |

|

World News

|

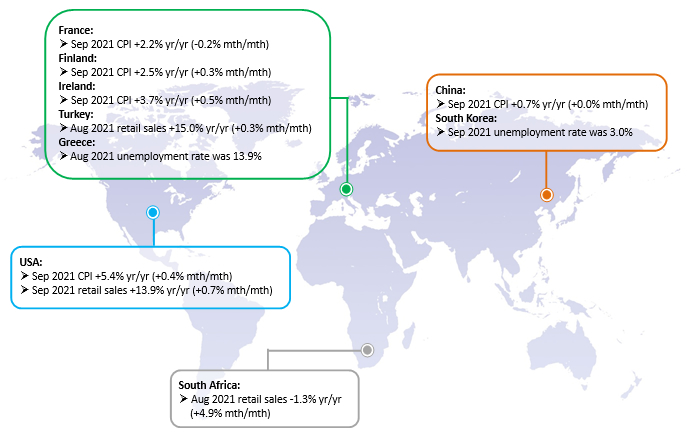

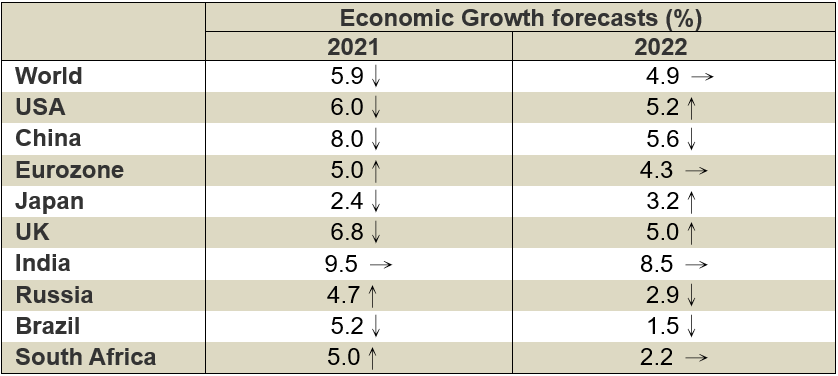

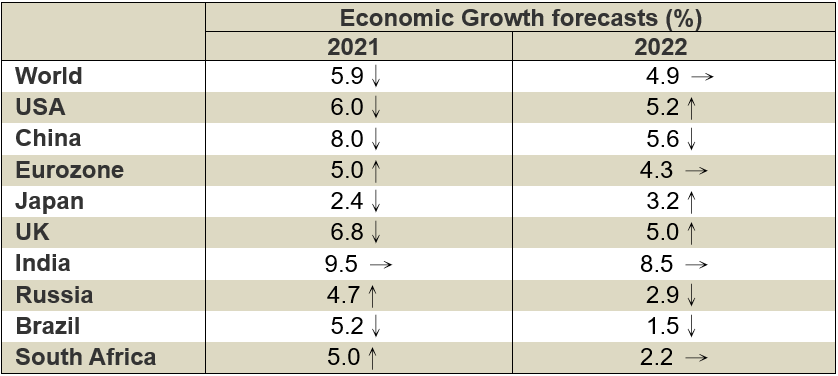

IMF lowers global growth outlook for 2021

In its October 2021 World Economic Outlook (WEO) report, the International Monetary Fund (IMF) slightly slashed its 2021 global growth forecast to 5.9% from 6.0% in its July’s projection. Growth prediction remained unchanged at 4.9% for 2022. The downward revision for 2021 reflects a downgrade for advanced economies, in part due to supply disruptions, and for low-income developing countries, largely due to worsening pandemic dynamics. This is partially offset by stronger near-term prospects among some commodity-exporting emerging market and developing economies amid rising energy prices.

*Arrows indicate the direction of revisions since July 2021. |

|

|

|

|

| Asia and Australasia |

China: September exports hit record high

China's foreign trade performance remained resilient in September. Data from the General Administration of Customs (GAC) showed that exports from China jumped 28.1% in September from the same month a year ago, compared with a 25.6% rise in August. China’s export value also hits a record high of US$305.7 billion in September, thanks to the robust global demand despite pressures including local power crunch, supply chain disruption and the still ongoing COVID-19 pandemic. Overall, both exports (+33.0%) and imports (+32.6%) experienced double-digit growth in the first nine months of the year. A GAC spokesperson told in a press conference that the fundamentals of China's long-term economic growth have not changed, noting stable domestic production and consumption demand provided strong support for the growth of China's foreign trade.

Australia: Business confidence improves amid reopening announcement

The latest Monthly Business Survey conducted by the National Australia Bank (NAB) showed that business confidence came in at +13 index points in September, rebounding substantially from -6 in August. The improvement was driven by large shifts in confidence in New South Wales (up 42pts to +27 index points) and Victoria (up 16pts to +5) following the announcement of reopening roadmaps in these states as well as rising vaccination rates across the country. The NAB added that a significant confidence boost is seen in recreation & personal services, wholesale trade, and retail. That said, current business conditions deteriorated significantly across all states, particularly NSW and Victoria, as lockdowns and disruptions continued to weigh on activity. |

|

| Europe |

UK: Retail sales growth slows in September

According to a joint survey conducted by British Retail Consortium (BRC) and advisory firm KPMG, total retail sales in UK increased by 0.6% yr/yr in September, compared with an average growth rate of 3.1% for the past three months. This also posts the slowest growth since January when the country was in lockdown. BRC’s chief executive Helen Dickinson commented that there are signs that consumer confidence is being hit as the fuel shortages, combined with wetter weather, had an impact in the second half of the month. In addition, larger purchases, such as furniture and homeware were particularly impacted as people were less likely to venture out in their cars to collect goods. |

|

| North America |

US: Biden signs bill to raise borrowing limit temporarily

Last week, US President Joe Biden signed a bill into law which increased temporarily the government’s borrowing limit to US$28.9 trillion until early December. The bill was finally approved by the Senate after some Republicans agreed to join Democrats and voted to end the Republican Party’s GOP delays. This move delayed the prospect of an unprecedented national default that would cause catastrophic effect on the economy, as US Treasury Secretary Janet Yellen had warned that it would run out of money to pay the nation’s bill on October 18. However, Senate minority leader Mitch McConnell has said Republicans will not support for another increase in debt limit in December. |

|

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Sas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong

Phone:2732 9988 Website:www.hkecic.com E-mail:info@hkecic.com |

Follow Us: |

|

|

|

Please do not reply to this email. If you would like to continue to receive these communications from us, you do not need to take any action.

However, if you no longer wish to receive email messages from HKECIC, please click “unsubscribe”

Copyright © 2021 Hong Kong Export Credit Insurance Corporation |

|