| [ 繁 | 简 | ENG ] |

|

|

|

|

| Issue 516 | 4 Jul 2022 |

|

Corporate News |

| Nike, Inc. (NYSE: NKE), a global athletic footwear and apparel retailer, published its fiscal fourth quarter and full year results ended 31 May 2022. Nike’s quarterly revenues were down 1% yr/yr to US$12.2 billion owing to decline of sales in Greater China (-19%) and North America (-5%), partially offset by strong sales in Asia Pacific & Latin America (+15%) and Europe, Middle East & Africa (+9%). Gross margin also decreased 80 basis points to 45%, primarily due to elevated freight and logistics costs, and inventories in China. For the full fiscal year, revenues were up 5% to US$46.7 billion. Gross margin improved 120 basis points to 46.0%, contributed by a higher share of full price sales via NIKE Direct business. The company also highlighted that its inventories were US$8.4 billion, up 23% compared to the prior year period, driven by elevated in-transit inventories due to ongoing supply chain disruptions. |

|

|

|

|

| Asia and Australasia |

Hong Kong: Exports down 1.4% yr/yr in May

The Census and Statistics Department reported that the value of Hong Kong's total exports of goods decreased by 1.4% yr/yr in May, reversing a rise of 1.1% in April. Total exports to Asia as a whole dropped by 2.7%. In particular, exports to Japan and the Mainland fell by 13.9% and 10.1% respectively. On the other hand, increases were recorded in exports to India (+93.5%), Malaysia (+46.7%), and Singapore (+32.6%). For the first five months of 2022 as a whole, the value of total exports of goods increased by 1.9% over the same period in 2021. A Government spokesman said that the merchandise exports turned to a mild year-on-year decline in May 2022 as the global economy faced increasing headwinds. Looking forward, the step-up in monetary policy tightening by many major central banks would further dampen global economic growth. The development of the situation in Ukraine and the lingering threat of the pandemic also added uncertainties. The worsened global economic prospects would continue to weigh on Hong Kong’s export performance.

Australia: Retail sales rise 0.9% mth/mth in May

According to the Australian Bureau of Statistics (ABS), Australian retail sales increased for the fifth straight month by 0.9% mth/mth to AUD 34.2 billion in May, a new record high. By industry, department stores (+5.1%) led the growth, followed by cafes, restaurants, and takeaway food services (+1.8%), and other retailing (+1.5%). Clothing, footwear, and personal accessory retailing (-1.4%) was the only industry to record a fall. Almost all states and territories posted a growth this month, except for Queensland (-0.4%) and the Australian Capital Territory (-0.3%). Ben Dorber, ABS Director of Quarterly Economy Wide Statistics, commented that the spending remained resilient and higher prices added to the growth in retail turnover in May. |

|

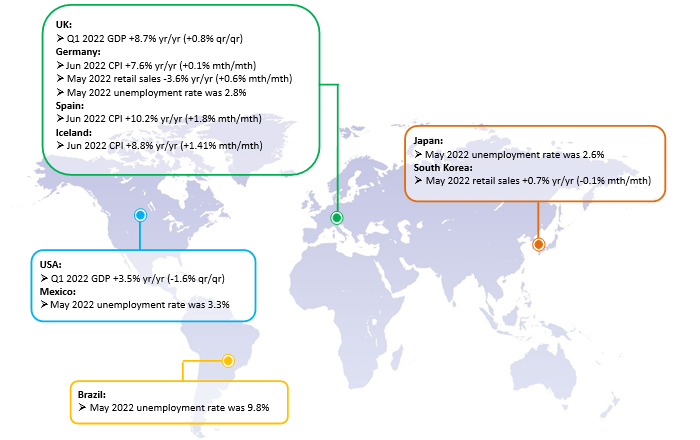

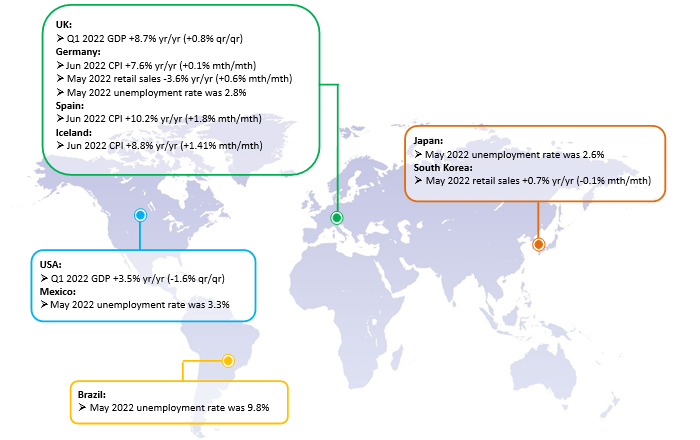

| Europe |

Germany: Consumer confidence slips amid high inflation

The GfK Consumer Confidence Index, a gauge measuring the level of optimism that consumers have about the performance of the economy in the next 12 months, stood at -27.4 points in July, down 1.2 points from -26.2 points in June. The index dropped to a record low since 1991. The propensity to buy also fell 2.6 points to -13.7 points. GfK said the war in Ukraine and disruptions in supply chains hindered production and led to skyrocket prices, in particular for energy and food, resulting in a gloomier consumer climate than ever. The economic expectation also declined 2.4 points to -11.7 points. Consumers continued to see a significant risk of the German economy slipping into recession. |

|

| Latin America |

Brazil: Central bank expects inflation already peaked

The Brazil's Central Bank (BCB) president Roberto Campos Neto signaled the worst of inflation was over for Brazil. Inflation was 11.73% yr/yr in May, down from 12.13% in April. He explained that these two inflation readings were within expectations. Thus, BCB believed the worst period of inflation in Brazil had passed and expected lower inflationary pressure. He also added that the central bank was already very close to completing rate hikes while other countries were in the middle of it. BCB raised rates by 50 basis points to 13.25% in June. In the central bank’s latest forecast, inflation would reach 8.8% in 2022, above the official target of 3.5%, and GDP growth for 2022 was lifted from 1% to 1.7%. |

|

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong

Phone:2732 9988 Website:www.hkecic.com E-mail:info@hkecic.com |

Follow Us: |

|

|

|

Please do not reply to this email. If you would like to continue to receive these communications from us, you do not need to take any action.

However, if you no longer wish to receive email messages from HKECIC, please click “unsubscribe”

Copyright © 2022 Hong Kong Export Credit Insurance Corporation |

|