| [ 繁 | 简 | ENG ] |

|

|

|

|

| Issue 621 | 19 Aug 2024 |

|

Bankruptcy News |

US home improvement retailer, LL Flooring (NYSE: LL) has filed for Chapter 11 bankruptcy, citing macroeconomic headwinds and operational challenges. The retail chain lined up US$130 million in financing to fund its operations during the bankruptcy. LL Flooring planned to close handful of underperforming stores while exploring potential sales of remaining locations. According to court documents, the flooring company had between US$500 million to US$1 billion in assets and owed between US$100 million to US$500 million.

Blink Fitness, a US-based gym chain, has filed for Chapter 11 bankruptcy protection with a plan to sell its business. The company secured US$21 million in financing that would support its operations through the bankruptcy process. In its filing, the company listed both assets and liabilities in the range of US$100 million and US$500 million. Blink blamed its bankruptcy on the lingering effects from the COVID-19 pandemic, which forced it to temporarily shut its operations and incur additional debt.

Avon Products Inc., the US-based holding company for the Avon beauty brand, has filed for Chapter 11 bankruptcy protection to ward off debt pressures and impacts from lawsuits. The company said its operations outside the US were not part of the proceedings, and secured sufficient financing to continue its normal operations throughout the process. In its filing, Avon listed estimated assets ranging from US$1 billion to US$10 billion and estimated liabilities in the same range. Reportedly, Avon had spent over US$225 million on legal defenses and settlements amid mounting litigation related to its products. |

|

|

|

|

| Asia and Australasia |

Singapore: Non-oil exports surge 15.7% yr/yr in July

Figures from the Enterprise Singapore showed that Singapore’s non-oil domestic exports (NODX) jumped by 15.7% yr/yr in July, reversing an 8.8% decrease in the prior month. Both electronics (+16.5%) and non-electronics (+15.5%) soared in the month. Integrated circuits (+13.5%) and disk media products (+113.2%) contributed the most to the rise in electronic exports. Meanwhile, petrochemicals (+28.1%) and non-monetary gold (+260.3%) led the growth in non-electronic exports. The increases were also registered to most major destinations, in particular China (+21.1%) and the US (+28.9%). On the other hand, exports to Japan (-7.9%), and the EU (-4.7%) posted modest declines. Economists expected exports would continue to recover on the back of better external demand. |

|

| Europe |

Eurozone: Industrial production contracts slightly in June

According to estimates from Eurostat, Eurozone’s seasonally adjusted industrial production fell by 0.1% mth/mth in June, narrowing from a 0.9% decrease in the previous month. The fall was chiefly the result of a 2.5% decline of output of non-durable consumers goods, such as food and clothing. On the other hand, the production of durable consumer goods (+3.8%), capital goods (+0.9%), and intermediate goods (+0.7%) grew. Among the largest member states, Germany (+1.6%) and France (+0.7%) returned to grow while Italy (+0.5%) continued to post expansions. On a yearly basis, industrial production contracted by 3.9%, following a 3.3% decline in May.

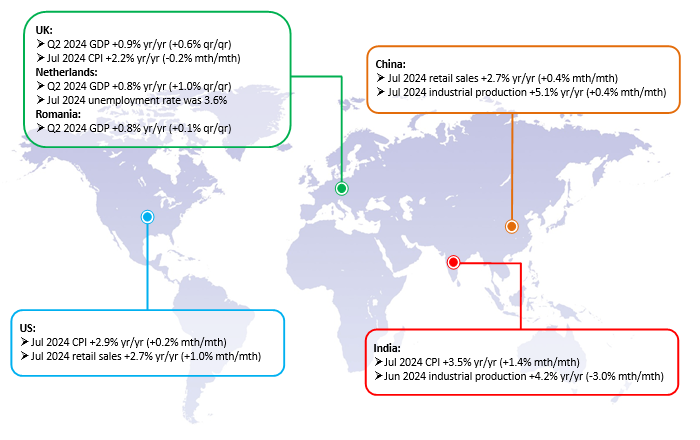

UK: Economy grows solidly in Q2

Preliminary data from the Office for National Statistics (ONS) showed that the UK economy grew by 0.6% qtr/qtr in Q2 2024, extending a 0.7% rise in Q1. There were increases in nearly all main components of expenditure in the quarter, with the largest contribution from gross capital formation, which contributed 2.4 percentage points to the increase in GDP. By industry, the service sector was a significant driver (+0.8%) in the quarter while the manufacturing and construction sector both contracted by 0.1% respectively. On an annual basis, UK GDP soared 0.9% in Q2, accelerating from a rise of 0.3% in the previous quarter. Economists expected the growth momentum would slow down in coming months due to the still-high interest rates. |

|

| North America |

US: Retail sales rebound in July

The Department of Commerce reported that the US retail and food services sales jumped 1.0% mth/mth in July, reversing a fall of 0.2% in the previous month and marking the biggest increase since January 2023. Among 13 business categories, ten recorded increases, led by motor vehicle & parts dealers (+3.6%) and electronics & appliance stores (+1.6%). Sales of building material & garden equipment (+0.9%), food & beverage (+0.9%) and health care products (+0.8%) also saw meaningful increases. Meanwhile, receipts at miscellaneous stores (-2.5%) and sport & hobby stores (-0.7%) fell. The so-called core retail sales, which exclude automobiles, gasoline, building materials and food services, grew 0.3%, following a rise of 0.9% in June. |

|

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong

Phone:2732 9988 Website:www.hkecic.com E-mail:info@hkecic.com |

Follow Us: |

|

|

|

Please do not reply to this email. If you would like to continue to receive these communications from us, you do not need to take any action.

However, if you no longer wish to receive email messages from HKECIC, please click “unsubscribe”

Copyright © 2024 Hong Kong Export Credit Insurance Corporation |

|