| [ 繁 | 简 | ENG ] |

|

|

|

|

| Issue 625 | 16 Sep 2024 |

|

Bankruptcy News |

| US discount home goods retailer Big Lots (NYSE: BIG) has filed for Chapter 11 bankruptcy protection with plan to sell its business. The company secured over US$700 million in financing to keep its business running during the bankruptcy process. Big Lots blamed macroeconomic headwinds for its bankruptcy, including high inflation and interest rates, which caused changes in consumer spending patterns. The company noted that its core customers curbed their discretionary spending on the home and seasonal product categories, putting pressure on company finances. In its filing, Big Lots listed its assets and liabilities in the range of US$1 billion to US$10 billion. The retailer also announced that a private equity firm would acquire substantially all of its stores and business operations, and expected to complete the acquisition later this year. |

|

|

|

|

| Asia and Australasia |

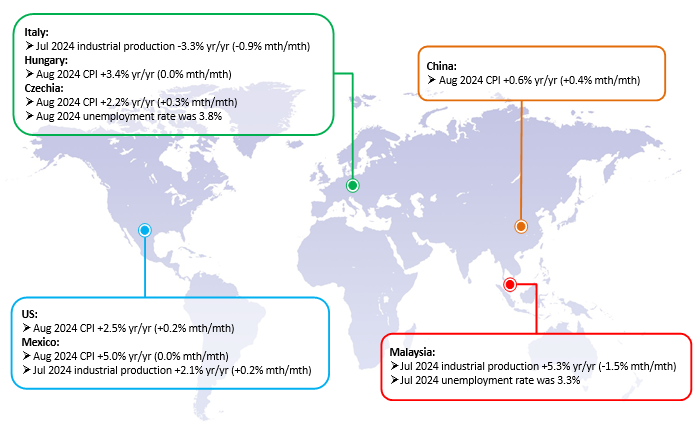

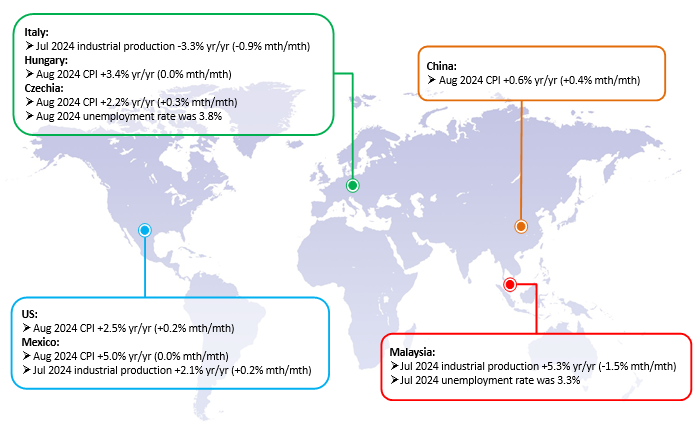

China: Solid export growth in August

Figures from the General Administration of Customs (GAC) showed that exports from China increased 8.7% yr/yr in August to US$308.65 billion, marking the strongest expansion since March 2023. Imports edged up by 0.5% to US$217.63 billion. Overall, China saw its trade surplus widened to US$91.02 billion in the month, compared with US$84.65 billion last month. For the first 8 months of 2024, outbound shipments grew by 4.6% to US$2,314.77 billion and imports increased by 2.5% to US$1,706.27 billion. By export product, automobiles (+20.0%), integrated circuits (+22.0%) and home appliances (+14.7%) continued to post strong gains while exports of cellphones contracted at a slower pace (-1.7%). Some analysts expected the momentum to hold up in coming months as exchange rate remained favourable and exporters could avoid the tariffs by taking alternate trade routes. |

|

| Europe |

Eurozone: ECB cuts rates by 25 basis points again

The European Central Bank (ECB) lowered its key deposit rate by 25 basis points to 3.5%, marking its second reduction this year. Recent inflation data came in broadly as expected and the restrictive financial conditions continued to weigh on demand. Consumers were spending less and businesses were also cutting back their investments. However, domestic price pressures remained strong due to the rising wages and sticky service inflation. The ECB now forecasted the bloc’s GDP to grow by 0.8% in 2024 and 1.3% in 2025, a slight downward revision from June projections due to subdued domestic demand. Headline inflation was expected to average at 2.5% in 2024 and 2.2% in 2025, unchanged from the June projections.

Turkey: Industrial production falls in July

According to the Turkish Statistical Institute, Turkey’s industrial output decreased by 3.9% yr/yr in July, narrowing from a decline of 5.0% in the prior month. The manufacturing sector contracted at a softer pace by 5.1% while the mining & quarrying (+3.3%) and utilities (+8.2%) sectors continued to grow. Among 29 major industries,

11 expanded in the month. The pharmaceutical products (-23.3%) and computer, electronic & optical products (-20.3%) industries were hardest hit. On a seasonally adjusted monthly basis, industrial production rebounded slightly by 0.4% in July, after a fall of 2.4% in the prior month. On a separate note, credit ratings agency Fitch upgraded Turkey's rating to ‘BB-‘ from ‘B+’, citing improved fiscal policy and foreign currency reserves. Fitch expected Turkey would grow at 3.5% this year, but decelerate to 2.8% next year in the face of high interest rates and cooling domestic demand. |

|

| North America |

US: Inflation falls to a 3-year low in August

The Bureau of Labor Statistics reported that the US annual inflation rate fell to 2.5% in August, marking the fifth straight drop and the lowest since February 2021. The slowdown was due to falling energy costs (-4.0%) and easing price pressures in used cars & trucks (-10.4%). Inflation for food (+2.1%) and transportation (+7.9%) remained steady. On the other hand, price pressures rose slightly for shelter (+5.2%) and apparel (+0.3%). Excluding volatile food and energy items, the so-called core inflation held steady at 3.2% in August. On a month-to-month basis, inflation remained at 0.2%. Analysts commented that the latest figures paved the way for the Federal Reserve to start cutting interest rates gradually from its 23-year high of 5.25%-5.50% in the September meeting. |

|

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong

Phone:2732 9988 Website:www.hkecic.com E-mail:info@hkecic.com |

Follow Us: |

|

|

|

Please do not reply to this email. If you would like to continue to receive these communications from us, you do not need to take any action.

However, if you no longer wish to receive email messages from HKECIC, please click “unsubscribe”

Copyright © 2024 Hong Kong Export Credit Insurance Corporation |

|