|

|

| |

|

|

| HKECIC Weekly Market News |

| 15 January 2018 |

|

|

|

| |

|

| |

| |

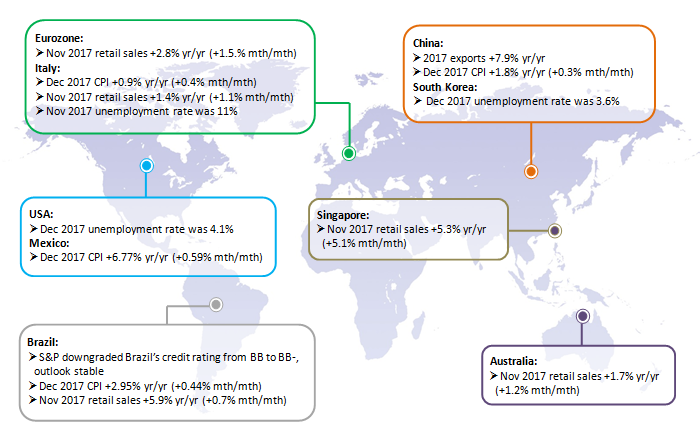

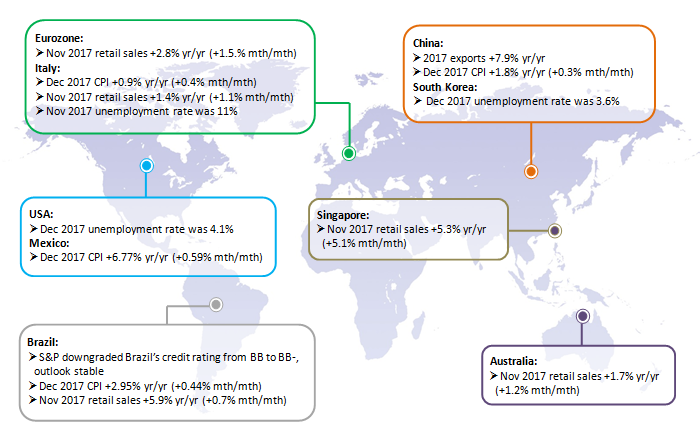

| Market Snapshots |

| Europe |

Eurozone: Unemployment at its lowest for nine years

Eurozone’s unemployment rate stood at 8.7% in November 2017, down from 8.8% in October 2017 and from 9.8% in November 2016. This is the lowest rate recorded since January 2009, at the time when the eurozone was suffering from a wave of debt crises. Among the Member States, the lowest rates were recorded in Malta and Germany (both 3.6%). The highest rates were observed in Greece (20.5% in September 2017) and Spain (16.7%). Separately, inflation in the currency bloc is expected to be 1.4% in December 2017, down from 1.5% in November 2017. Energy is expected to have the highest rate in December (3.0%), followed by food, alcohol & tobacco (2.1%), services (1.2%) and non-energy industrial goods (0.5%). |

|

|

| North America |

Canada: Businesses more upbeat about future

The latest business outlook survey conducted by the Bank of Canada suggests widespread positive business sentiment in the country. Canadian firms were more optimistic about the future than three months ago, with plans to increase investment and employ more people over the next 12 months given stronger demand. In particular, the surveyed businesses viewed that labour shortages were more intense than a year ago which restricted their ability to meet demand. Shortages were most evident in occupations related to information technology, tourism and construction. In December, Canada’s unemployment rate fell to 5.7%, posting the lowest rate in four decades. |

|

|

| Latin America |

Argentina: Central bank cuts interest rate by 0.75%

Argentina’s central bank has trimmed its benchmark interest rate from 28.75% to 28%, its first rate cut in 14 months as inflation has continued to ease. In November, inflation rate stood at 20.9%, down from around 40% a year ago. Earlier, the government set an inflation target of 15% for 2018 and expected the inflation to go down to 5% in 2020. While Argentine central bank President Federico Sturzenegger said taming inflation would remain the bank’s priority, lower inflation should pave the way for a looser monetary stance in the coming years. |

|

|

| Africa |

Tunisia: Anti-austerity protests spread

Violent demonstrations have erupted across Tunisia against government austerity measures. In an effort to cut the budget deficit to 4.9% of GDP in 2018 from 6.0% in 2017, the government implemented a series of austerity measures, including a slash in energy subsidies and an increase in value-added tax. These are part of the reform priorities adopted by the government to persuade the International Monetary Fund (IMF) to release a loan of US$320 million, which was originally scheduled for October 2017. In December, the IMF said Tunisia needed to take decisive action to reduce its deficit.

Angola: Currency peg to US dollar abandoned

The value of Angola's currency kwanza slipped by 10% against the US dollar, after the country ditched its currency peg against the US dollar in order to slow the depletion of foreign reserves. Angola is an oil producer and oil accounts for roughly 90% of government revenue. While oil prices are now moving upwards, low prices in recent years have hit Angola’s economy, with foreign reserves falling to around US$14 billion at the end of 2017 from US$28 billion at the end of 2014. Although the exchange rate liberalization might help the country shake up its economy, the depreciation would increase inflationary pressure and further erode the spending powers of Angolans in the short term. |

|

|

|

| |

|

|

|

| |

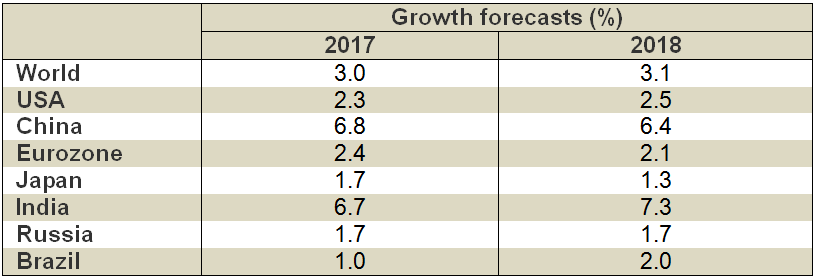

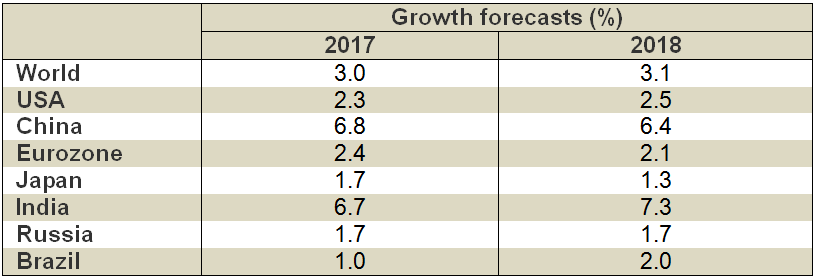

World Bank: Global economic growth to edge up to 3.1% in 2018

In its latest Global Economic Prospects, the World Bank forecasts global economic growth to notch up to 3.1% in 2018 from 3.0% in 2017 on the back of the recovery in investment, manufacturing activity and trade. Considering emerging market and developing economies as a whole, the bank expects economic growth to strengthen from 4.3% last year to 4.5% this year, as activity in commodity exporters continues to recover. However, growth in advanced economies is expected to slow from 2.3% last year to 2.2% this year, as major central banks gradually remove their post-financial crisis accommodation.

|

|

|

|

|

| |

KIKO USA, Inc., a US-based retailer of professional makeup and skincare products, has filed for Chapter 11 bankruptcy protection. The company plans to close most of its stores, blaming the downturn in the bricks-and-mortar retail industry. According to court filing, the company listed both assets and liabilities in the range of US$1 million to US$10 million.

|

|

|

| |

| |

| |

Hong Kong Export Credit Insurance Corporation

2/F., Tower I, South Seas Centre, 75 Mody Road, Tsimshatsui East, Kowloon, Hong Kong. |

| Phone:(852) 2732 9988 Website : www.hkecic.com HKECIC website : info@hkecic.com |

| If you do not want to receive the email messages from HKECIC in the future, please click unsubscribe |

|

|

|

| |

Copyright © 2018 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|