|

|

| |

|

|

| HKECIC Weekly Market News |

| 23 April 2018 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

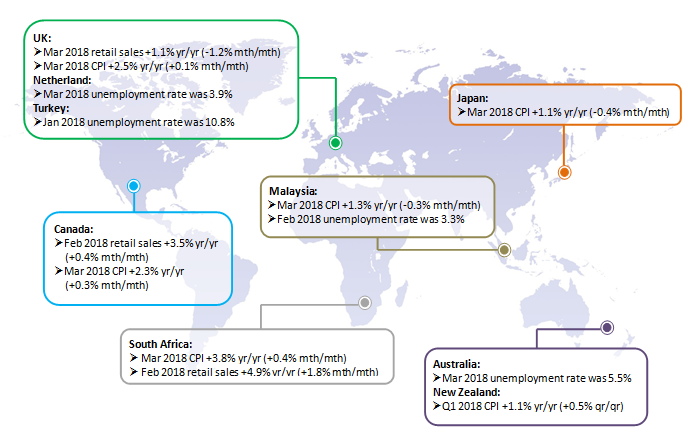

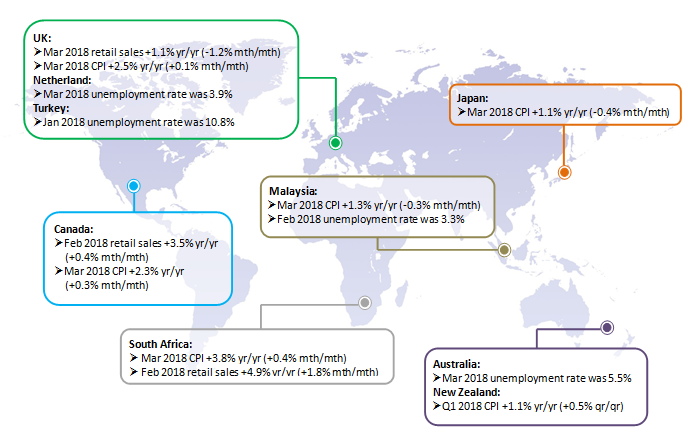

| Asia and Australasia |

China: Economy grows 6.8% yr/yr in Q1

The Chinese economy grew 6.8% yr/yr in Q1, the same rate as the previous quarter and above the government’s growth target of about 6.5% for 2018, data from the National Bureau of Statistics (NBS) showed. Expansion of real estate development investment (+10.4%), private investment (+8.9%) and retail sales (+9.8%) were the main drivers of growth. Separately, following anti-dumping investigations, China’s Ministry of Commerce announced to impose a temporary deposit rate of 178.6% on US sorghum imports and a rate ranged between 26.0% and 66.5% on chlorobutyl rubber imported from US, European Union and Singapore, citing such imports had caused substantial damage to the domestic industry. The moves have come into effect from 18 and 20 April 2018 respectively.

Singapore: Exports down 2.7% yr/yr in March

According to Enterprise Singapore, non-oil domestic exports (NODX) decreased by 2.7% yr/yr in March, following the 6.0% decline in the previous month, due to the decrease in both electronic and non-electronic exports. Electronic NODX declined 7.1%, led by part of PCs (-51.2%), ICs (-6.3%) and diodes & transistors (-24.6%). Non-electronic NODX dropped 1.3%, mainly contributed by non-monetary gold (-55.1%), structural parts made up of iron, steel & aluminum (-95.3%) and aircraft parts (-53.6%). By market, NODX to the top 10 markets grew in March, except China, Hong Kong, Thailand and Malaysia. The largest contributors to the NODX growth were the US (+32.6%), Japan (+21.6%) and the European Union (+11.3%). |

|

|

| Europe |

Eurozone: Trade surplus widens in February

Eurozone’s surplus in goods trade stood at EUR 18.9 billion in February 2018, widening from EUR 16.1 billion in the same month a year ago, according to estimates from Eurostat, the statistical office of the European Union. Total exports of goods in February 2018 rose 3.0% yr/yr to EUR 177.5 billion, while imports grew at a slower 1.5% to EUR 158.6 billion. Separately, annual inflation in the currency bloc was 1.3% in March, up from 1.1% in February. Among the member states, the highest inflation rates were recorded in Estonia (2.9%), Slovakia and Lithuania (both 2.5%). The lowest rates were registered in Cyprus (-0.4%), Greece (0.2%) and Denmark (0.4%). |

|

|

| North America |

US: Retail sales rebound in March

According to the Department of Commerce, US retail sales rose 0.6% mth/mth in March, recovering from a 0.1% drop in February. This marked the first increase in retail sales after three consecutive monthly declines, driven by a rebound in sales at motor vehicle & parts dealers, electronics & appliance stores and health & personal care stores. Considering the first quarter of 2018, retail sales edged up 0.2% from the fourth quarter of 2017. It is expected that a strong labour market and the impact of tax cuts will be supportive of US spending growth in the near term. However, some businesses in US are worried about the newly imposed and/or proposed tariffs, Federal Reserve reported in its Beige Book. |

|

|

|

| |

|

| |

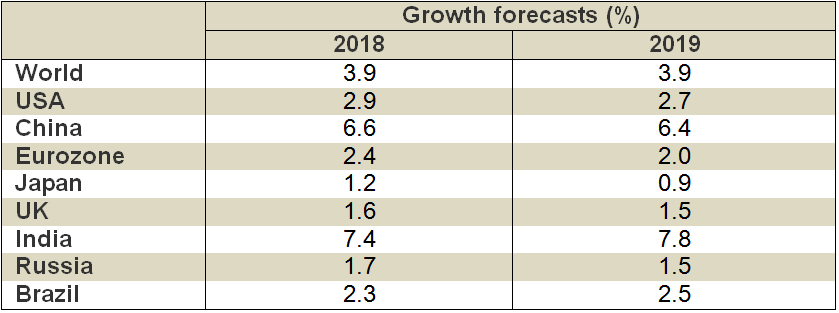

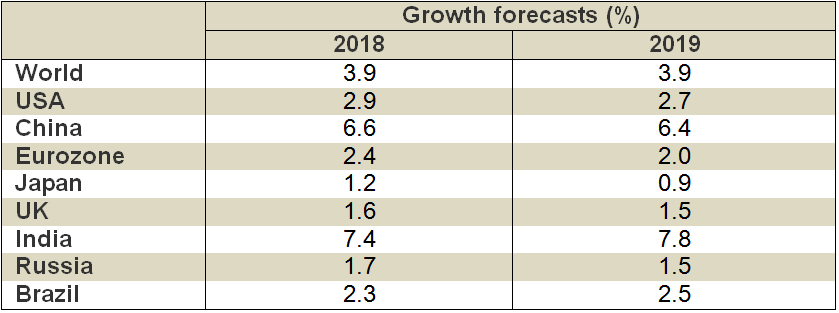

IMF: Global growth is expected to grow 3.9% this year and next

The International Monetary Fund (IMF) projects the global economy to grow at 3.9% in 2018, up from 3.8% last year and the fastest pace since 2011. Growth is expected to be supported by strong momentum, favorable market sentiment, accommodative financial conditions, and the domestic and international repercussions of expansionary fiscal policy in the United States. However, the IMF warned that an increase in tariffs and nontariff trade barriers could disrupt global supply chains, reducing global productivity and investment.

|

|

|

|

|

| |

The US Department of Commerce has imposed a ban on American companies from exporting prohibited commodity, software or technology directly or indirectly to ZTE Corporation (SZSE: 000063 and HKEX: 0763), with immediate effect. The ban will remain effective until 13 March 2025. |

|

|

| |

| |

| |

Hong Kong Export Credit Insurance Corporation

2/F., Tower I, South Seas Centre, 75 Mody Road, Tsimshatsui East, Kowloon, Hong Kong. |

| Phone:(852) 2732 9988 Website : www.hkecic.com HKECIC website : info@hkecic.com |

| If you do not want to receive the email messages from HKECIC in the future, please click unsubscribe |

|

|

|

| |

Copyright © 2018 Hong Kong Export Credit Insurance Corporation |

|

|

|