|

|

| |

|

|

| HKECIC Weekly Market News |

| 18 Februrary 2019 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Asia and Australasia |

China: Exports shot up in January, despite US trade war

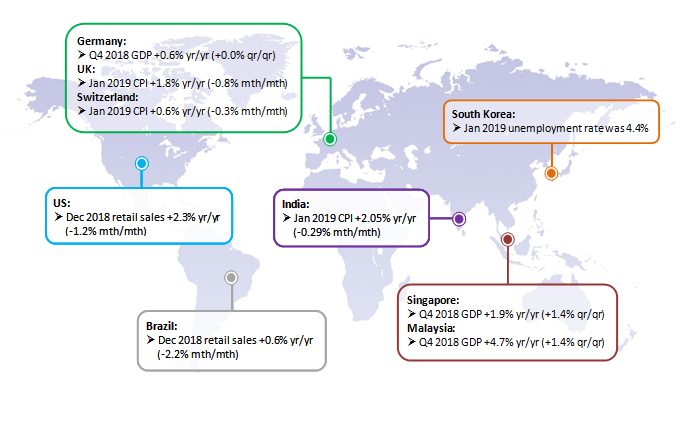

According to the General Administration of Customs, China’s exports rose 9.1% yr/yr to US$217.6 billion in January, rebounding from a 4.4% drop in December 2018. Imports dropped 1.5% yr/yr to US$178.4 billion in January, following a 7.6% drop in December 2018. Overall, China registered a total trade surplus of US$39.2 billion in January, widening from US$18.4 billion a year earlier. Separately, the latest round of trade negotiations between the US and China was ended last week, both Chinese and American officials reported progress, committing to further meetings in Washington this week.

Singapore: Retail sales dipped 6% in December 2018

Data from the Department of Statistics showed that Singapore's retail sales fell 6.0% yr/yr to about SGD 4.3 billion in December 2018 after a 2.4% yr/yr decrease in November. This marked the steepest decline in retail sales since January 2018, led by motor vehicles (-20.7%), computer & telecommunications equipment (-16.8%) as well as recreational goods (-5.8%). Excluding motor vehicles, retail sales dropped 3.0%. Separately, the Singapore economy grew by 3.2% in 2018, moderated from 3.9% in 2017, data from the Ministry of Trade and Industry (MTI) showed. GDP increased by 1.9% yr/yr in the last three months of 2018, well below the third quarter's 2.4% and its advance estimate of 2.2%. MTI also warned that the manufacturing sector was likely to see a significant moderation in growth, although it kept its growth outlook for 2019 in the range of 1.5% to 3.5%. |

|

|

| Europe |

Eurozone: Industrial production dips in December 2018

Eurozone’s industrial production fell by 0.9% mth/mth in December 2018, following a 1.7% contraction in November, according to estimates from Eurostat. The production of both capital goods and non-durable consumer goods fell by 1.5% and energy by 0.4%, while production of intermediate goods remained unchanged and durable consumer goods rose by 0.7%. Separately, Eurozone’s GDP increased by 1.2% yr/yr in the fourth quarter of 2018, slowing from 1.6% in the last quarter. Over the whole year 2018, GDP rose by 1.8%, slowing from 2.4% in 2017. With a subdued economic momentum at the start of the year, the European Commission has lowered its forecast for the eurozone’s GDP growth to 1.3% in 2019 and 1.6% in 2020 (down from its autumn forecast of 1.9% and 1.7%), adding that a high level of uncertainty surrounds the economic outlook and the projections are subject to downside risks. |

|

|

| North America |

US: Inflation held steady in January

The Department of Labour reported that the Consumer Price Index (CPI) was unchanged mth/mth for the third straight month in January on a seasonally adjusted basis. The indexes for shelter, apparel, medical care, recreation, and household furnishings and operations were among the indexes that rose in January, while the indexes for airline fares and motor vehicle insurance declined. On a yearly basis, the CPI rose 1.6% in January, slowing from 1.9% rise in the preceding month and posting the smallest gain since June 2017. This echoed Federal Reserve Chairman Jerome Powell’s view that the risk of inflation flaring appears to have diminished and increasing the likelihood that the Fed would hold the target range for the federal funds rate at 2.25% to 2.5% in its March meeting. |

|

|

|

| |

|

| |

|

|

| |

Imerys Talc America Inc, a US-based talc manufacturer and a key supplier to healthcare conglomerate Johnson & Johnson’s baby powder, has filed for Chapter 11 bankruptcy protection as the company faces multibillion-dollar lawsuits alleging its products caused cancer. The company’s president said in a press release that pursuing Chapter 11 protection is the best course of action to address the historic talc-related liabilities and position the filing companies for continued growth. The companies will be operating as usual throughout the Chapter 11 process and expected to emerge by 2020. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2019 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|