|

|

| |

|

|

| HKECIC Weekly Market News |

| 3 December 2018 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

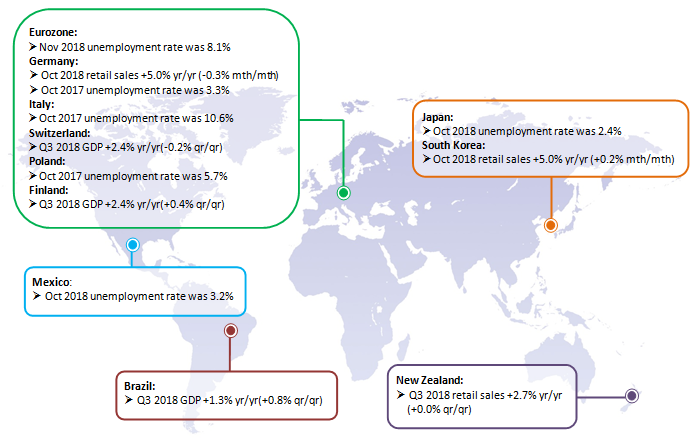

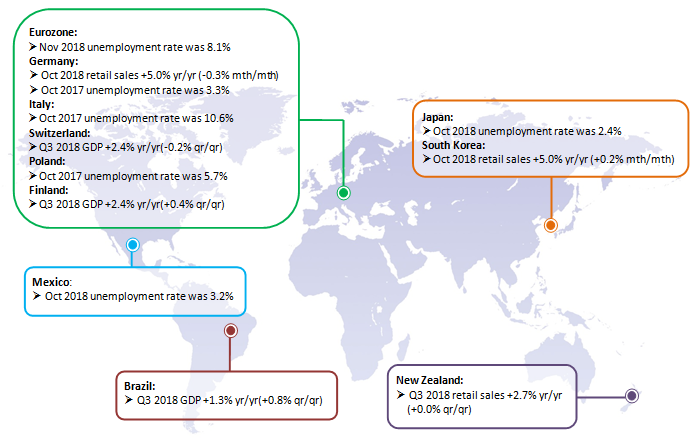

| Asia and Australasia |

Hong Kong: Exports up 14.6% yr/yr in October

The Census and Statistics Department reported that the value of Hong Kong's total exports of goods increased 14.6% yr/yr in October, after going up 4.5% in September. For the first ten months of 2018 as a whole, the value of Hong Kong's total exports of goods rose by 9.8% over the same period in 2017. The increases were registered to most major destinations, in particular the Mainland China (+12.3%), Singapore (+10.8%), Thailand (+10.4%), the USA (+9.5%), the Netherlands (+8.8%) and Vietnam (+8.4%). Separately, members of the World Trade Organization (WTO) commended Hong Kong again for its free and open trade regime at the Trade Policy Review meeting held on 28 November 2018. In concluding remarks, the Chairperson of the meeting praised Hong Kong for maintaining one of the most open and market-oriented economies in the world, and achieving robust economic growth, despite a challenging external environment.

Japan: Retail sales grew at the fastest pace in 10 months

According to the Ministry of Economy, Japanese retail sales post the fastest growth in 10 months to 3.5% yr/yr in October. On a seasonally-adjusted basis, sales increased 1.2% mth/mth in October, up from 0.4% in September, in a sign that private consumption began to rise again in the Q4, following the decline in Q3 hit by natural disasters and sluggish exports. Despite the outlook for export-reliant Japan has been clouded by the US-China trade tension, the economy is widely expected to return to growth in Q4 as private consumption accounts for roughly 60% of the Japanese economy. |

|

|

| Europe |

Germany: Sentiment among German businesses weakened further in November

Business survey from the Munich-based Ifo Institute showed that the German business confidence has weakened for the third straight month in November. The Business Climate Index fell from 102.9 points in October to 102.0 points in November. In particular, the business climate indicator deteriorated in all sectors (manufacturing, service, trade and construction). The Institute attributed the decline due to companies scaling back their assessments of the current business situation albeit from a high level. The Institute added that these results, together with other indicators, point to a 0.3% economic growth in the fourth quarter at most and the German economy is cooling down. |

|

|

| North America |

US: US will hold off raising China tariffs to 25%

The 2018 Group of Twenty (G20) Buenos Aires summit was held last week. US President Donald Trump met Chinese President Xi Jinping for a working dinner during the summit, and both leaders discussed over trade issues. China and the US have agreed to halt additional tariffs as both nations engage in new trade negotiations with the goal of reaching an agreement within 90 days. Trump agreed not to raise tariffs on US$200 billion of Chinese goods from 10% to 25% on 1 January 2019 as previously announced, while China committed to purchase an unspecified but very substantial amount of agricultural, energy, industrial and other products from the US, the White House said in a statement. Additionally, President Xi said China would be open to approving renewed Qualcomm-NXP deal if it comes up again. |

|

|

|

| |

|

| |

|

|

| |

General Motors Company (GM), a US-based automobile maker, announced a major restructuring of its global business. It planned to lay off 15% of its salaried workers and close five plants in US and Canada. The cuts will eliminate approximately 8,000 salaried workers, including 25% of executives, and an additional 6,000 hourly workers will either lose their jobs or be transferred. GM said it will take pre-tax charges of US$3 billion to US$3.8 billion to pay for the cutbacks, but expects the actions to improve annual free cash flow by US$6 billion by the end of 2020. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2018 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|