|

|

| |

|

|

| HKECIC Weekly Market News |

| 2 September 2019 |

|

|

|

| |

|

| |

| |

| Market Snapshots |

| Asia and Australasia |

Hong Kong: Exports decreased by 5.7% yr/yr in July

The Census and Statistics Department reported that the values of Hong Kong's total exports of goods decreased by 5.7% yr/yr to HK$ 338.6 billion in July, after a decrease of 9.0% in June. For the first seven months of 2019 as a whole, the value of total exports of goods dropped by 3.9% over the same period in 2018. Decreases were registered in some major destinations, in particular India (-15.1%), the USA (-10.9%), Germany (-7.6%), the Mainland China (-6.1%) and Taiwan (-4.6%). However, year-on-year increases were registered in the values of total exports to Singapore (+9.8%) and Korea (+4.4%). A Government spokesman said that the fall in value of merchandise exports in July was affected by softening global economic growth and US-China trade tensions. Looking forward, in the face of the difficult external environment and the further escalation of US-China trade tensions in September, Hong Kong's near-term export performance should remain sluggish or may even weaken further.

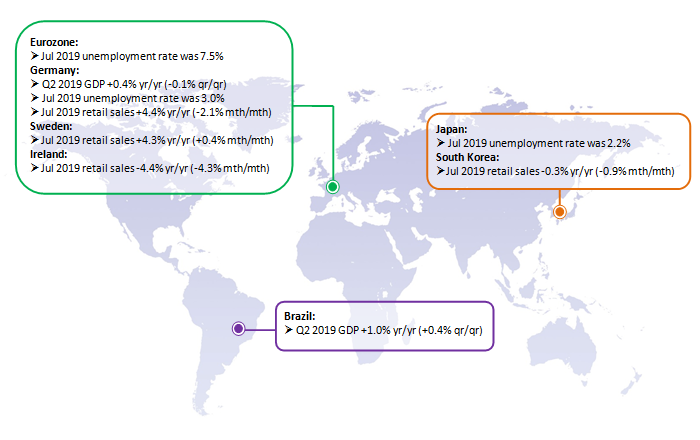

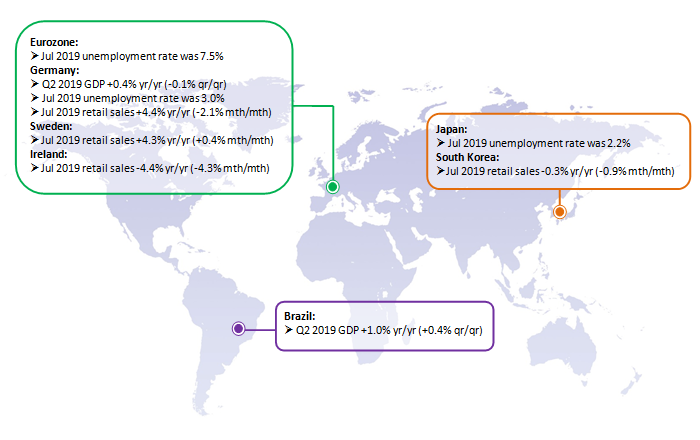

Japan: Retail sales drops at the fastest pace in three years

According to the report from Ministry of Economy, Trade and Industry, Japan’s retail sales fell 2.3% mth/mth in July, falling at its quickest pace in 3 years and raising concern that a slowing domestic demand will take a toll on the economy. On a yearly basis, retail sales sank 2.0%, following the 0.5% increase in the previous month. Fabrics apparel & accessories and Machinery & equipment declined 5.3% and 8.1% in July respectively, compared to a growth of 4.2% and 5.5% in the preceding month. Meanwhile, sales fell further for general merchandise (-5.8%) and fuel (-6.0%). |

|

|

| Europe |

Germany: Business sentiment dips to lowest since November 2012

Business survey from the Munich-based ifo Institute showed that the Business Climate Index fell from 95.8 in July to 94.3 points in August. The index has fallen for the fifth straight month, marking its lowest level since November 2012. Companies were once again much less satisfied with their current business situation. Pessimism regarding the coming months also increased. Confidence deteriorated among all business sectors, including manufacturing, trade, services and construction. In particular, the business climate indicator for trade slid into negative territory, with the decline driven primarily by wholesaling. |

|

|

| Latin America |

Argentina: Extends debt maturities and imposes capital controls

Struggling with a collapse in the peso and its bonds, the Argentina’s government is seeking to postpone US$ 7 billion of payments on short-term local notes held by institutional investors this year and will seek re-profiling of US$ 50 billion of longer-term debt, Economy Minister Hernan Lacunza said. It will also start talks over the repayment of US$ 44 billion it has received from the International Monetary Fund (IMF).The Argentina’s government also authorized currency controls to halt a slump in foreign currency reserves. The latest round of volatility began when President Mauricio Macri suffered a harsh defeat in the primary election at the hands of populist-leaning Alberto Fernandez. |

|

|

|

| |

|

| |

|

|

| |

American lifestyle retailer Abercrombie & Fitch Company (NYSE: ANF) announced its financial results for the second quarter ended 3 August 2019. Net sales decreased 0.2% to US$ 841.1 million, and comparable sales were flat against a growth of 3% last year. An operating loss of US$ 39.5 million was recorded, against a profit of US$ 0.2 million last year. The company now expects annual sales to be in the range of flat to up 2%, down from a rise of 2% to 4% estimated previously. In addition, Abercrombie said that the additional tariffs on US$ 550 billion worth of Chinese imports were expected to have a direct adverse impact on cost of merchandise and gross profit of about US$ 6 million for the fall season. |

|

|

| |

|

|

| |

Hong Kong Export Credit Insurance Corporation

2/F, Tower 1, South Seas Centre, 75 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong |

| Phone:(852) 2732 9988 Website : www.hkecic.com E-mail : info@hkecic.com |

| If you no longer wish to receive email messages from HKECIC, please click "unsubscribe". |

|

|

|

| |

Copyright © 2019 Hong Kong Export Credit Insurance Corporation |

|

|

|

|

Disclaimer

The information contained in the ‘Weekly Market News’ (WMN) is compiled by the Hong Kong Export Credit Insurance Corporation ("HKECIC") for general information only. Whilst HKECIC endeavours to ensure the accuracy of this general information, no statement, representation, warranty or guarantee, express or implied, is given as to its accuracy or appropriateness for use in any particular circumstances.

HKECIC is not responsible for any loss or damage whatsoever arising out of or in connection with any information including data or programmes on the WMN. HKECIC reserves the right to omit, suspend or edit all information compiled by HKECIC on the WMN at any time in its absolute discretion without giving any reason or prior notice. Users are responsible for making their own assessment of all information contained in this WMN and are advised to verify such information and obtain independent advice before acting upon it.

|

|